Asset Manager Panelists Agree: “There’s Beta in My Alpha!”

NISA’s CEO and Head of Investment Strategies David Eichhorn participated in a panel discussion at the Treasury Market Conference held this Fall at the

NISA’s CEO and Head of Investment Strategies David Eichhorn participated in a panel discussion at the Treasury Market Conference held this Fall at the

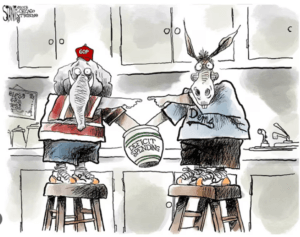

Watch Chief Economist Stephen Douglass as he examines America’s ever-rising debt burden, reviews the difficult policy options for addressing it and considers the implications

The U.S. economy suffered from the worst labor shortage in at least six decades during the pandemic. This imbalance peaked in late 2021 with

as an institutional asset manager

under management

employees

$283 billion in physical assets + $163 billion in derivatives notional value as of 09/30/2024.

David G. Eichhorn, CFA

Chief Executive Officer and Head of Investment Strategies

NISA was again named a Greenwich Quality Leader in U.S. Institutional Management Services, presented by Coalition Greenwich, for the eleventh year in a row on December 11, 2024. The award highlights asset managers who distinguish themselves from competitors by delivering superior levels of client service that help institutional investors achieve their investment goals and objectives.

The 2024 Greenwich Awards were announced by Coalition Greenwich on December 11, 2024. NISA paid a standard fee to access the full set of data published by Coalition Greenwich and for use of the Greenwich Quality Leader logo. Between February and September of 2024, Coalition Greenwich conducted interviews with 699 institutional investors from 563 of the largest tax-exempt funds in the United States. These U.S.-based institutional investors are corporate, public, union, healthcare and endowment and foundation funds, with either pension or investment pool assets greater than $150 million NISA was one of two 2024 recipients. Rankings do not represent any one client’s experience because they reflect an average of experiences of clients who chose to participate. Visit www.greenwich.com for more details, including past rankings and methodology.

NISA’s culture fosters personal and professional growth with access to both experience and expertise. See if a career at NISA is right for you.

NISA Investment Advisors, LLC is an independent, employee owned investment management firm. We focus on risk-controlled asset management for large institutional investors.

Please subscribe me to NISA Perspectives, Primers, News and Quarterly Economic Webinar Updates.

Follow us: