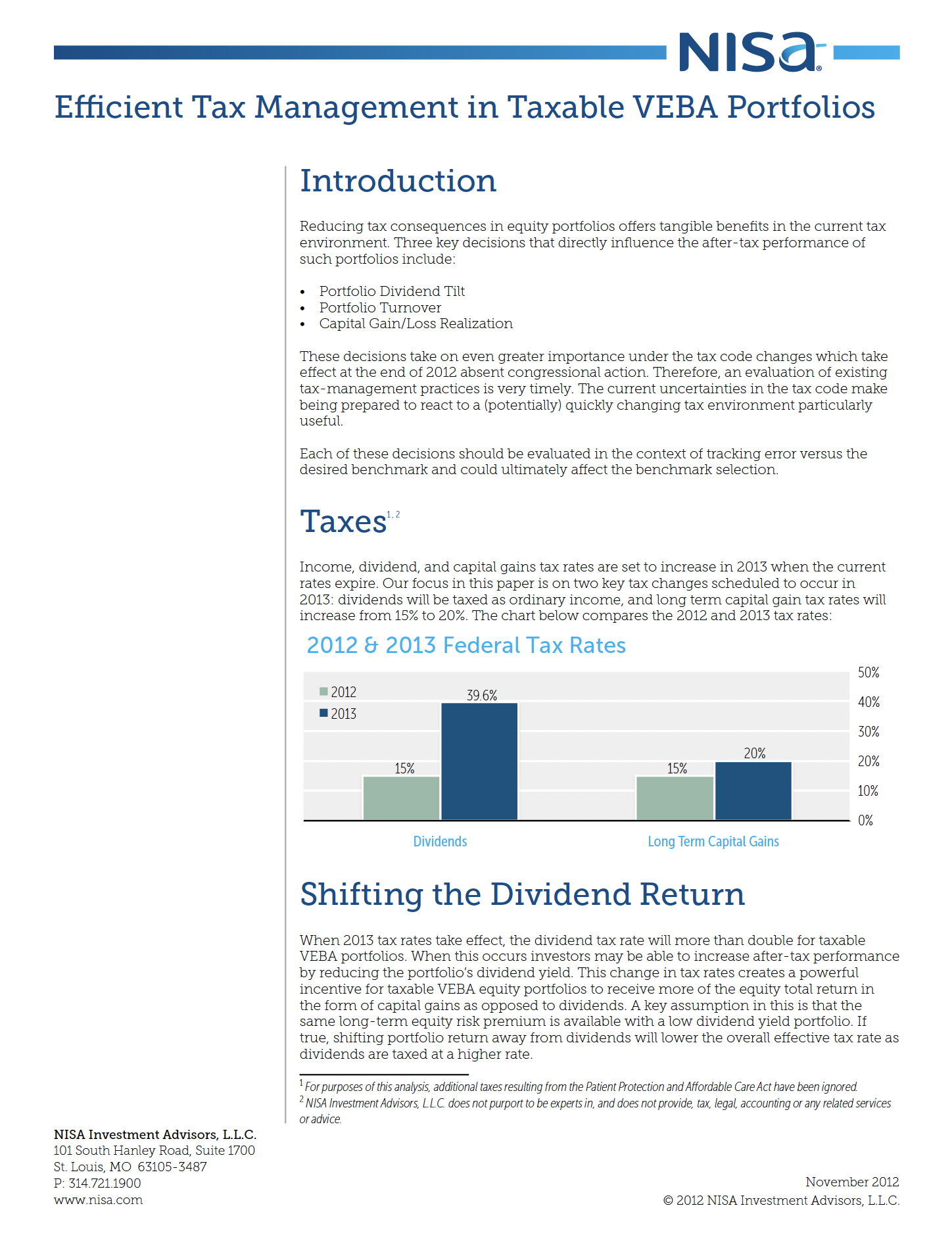

Reducing tax consequences in equity portfolios offers tangible benefits in the current tax environment. Three key decisions that directly influence the after-tax performance of such portfolios include 1) portfolio dividend tilt, 2) portfolio turnover, and 3) capital gain/loss realization. Each of these decisions should be evaluated in the context of tracking error versus the desired benchmark and could ultimately affect the benchmark selection.

Brazil Downgraded to Junk—But It’s Not High Yield!

Brazil’s sovereign debt was recently downgraded below investment grade (IG). Before the downgrade, its index-eligible bonds were included in both the Barclays US Credit Investment Grade Index and the JPMorgan...

December 2015