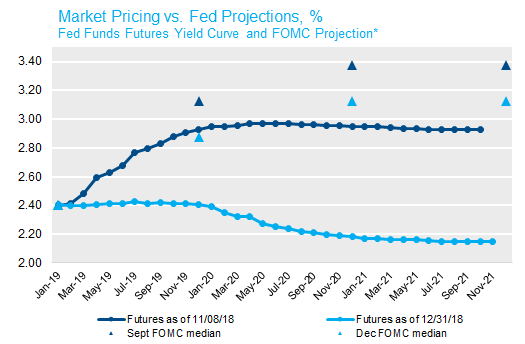

The last seven weeks have seen a dramatic repricing of the expected path of monetary policy. As recently as November 8, the fed funds futures market was pricing the Fed to hike all the way to 3%. Since then, more than two hikes have been removed from the expected path of policy. The fed funds futures yield curve is now essentially flat near today’s rate of 2.40% through the end of 2019 and downward sloping thereafter. According to the collective wisdom of the market, the December rate hike was the last of this cycle. If this prediction comes true, the tightening cycle that began in December 2015 will have delivered half as many hikes as the 2004 cycle, and will conclude at the lowest terminal rate in the Fed’s history.

Sources: Bloomberg, Federal Reserve.

*Summary of Economic Projections released with FOMC meetings on September 26 and December 19.

The main driver of the shift in policy expectations has been the volatile tightening of financial conditions. With industrial production growing near a 4% annual pace and four-month average payroll growth still running at 200,000 jobs, the data continue to reflect a very strong economy. The FOMC’s Summary of Economic Projections forecasts only a modest slowing of the growth rate, and consequently projects three more rate hikes in the next two years (down from four hikes at the September meeting). But economic data are notoriously backward-looking, and a 14% decline in the S&P 500 and 47 basis point widening in long credit spreads in the fourth quarter suggests market participants are increasingly looking ahead to growing risks on the horizon. Chief among these are a weaker foreign growth outlook and ongoing uncertainty surrounding the trade war with China. But commentators (not just the President) increasingly cite the possibility that monetary policy itself – particularly the shrinking of the Fed’s balance sheet – might be unduly deflating asset prices.

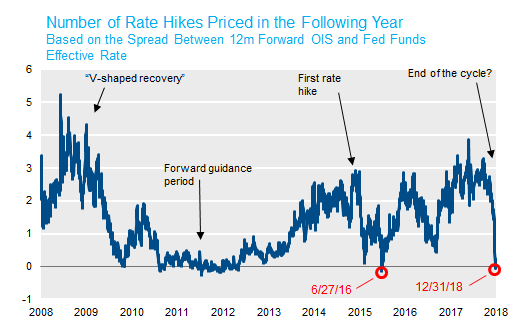

This is the second time since 2008 that short rate markets have priced the end of the tightening cycle (as shown in the chart below). The previous was in the second quarter of 2016, after a sharp downgrade in the Chinese growth outlook spooked global markets. With the benefit of hindsight, we know that the market’s worst fears in 2016 were not realized. After the 30-year Treasury yield hit an all-time low of 2.10% in July of 2016, risk asset prices rebounded to set new record highs, the US economy accelerated to the highest sustained rate of growth since the crisis, and the Fed delivered eight more rate hikes. Whether the current moment truly does represent the end of the cycle, or merely a brief interruption as in 2016, will depend on whether the economic data decline towards the market’s pessimistic outlook or risk sentiment rebounds to a level more consistent with recent economic data.

Source: Bloomberg.