Gold is a hot topic these days. It is not hard to understand why: negative real yields exist on inflation protected U.S. Treasuries (TIPS) all the way out the curve, monetary policy has inflation hawks standing at full attention, and the recent performance of the U.S. dollar has left a lot to be desired. That said, exploring the merits of gold investing is not the subject matter of this perspectives piece.

The thoughts we would like to share come from opportunities we see related to this renewed interest in gold. Namely, the potential to more efficiently obtain gold exposure if interested in gold exposure, and/or ways to capitalize on the pricing currently present in the gold futures market even if you have no interest in gold exposure.

Is there a difference between physical gold and gold futures?

Many investors in gold (or any other commodity) obtain their exposure through a futures contract. This is very convenient because it doesn’t require the storage of the commodity or risk spoilage, leakage, or theft in the case of some commodities. It has the added benefit for some of not requiring a full outlay of cash to obtain the exposure. Since the futures price converges to the spot price as the delivery period approaches, the fundamental economic exposure to the underlying commodity is ensured.

There is a subtlety, however, in that embedded in the futures price of a commodity is an assumption on the storage cost of the commodity and the time value of money. In the case of gold, these two costs are readily observable and they can be compared to the futures price.

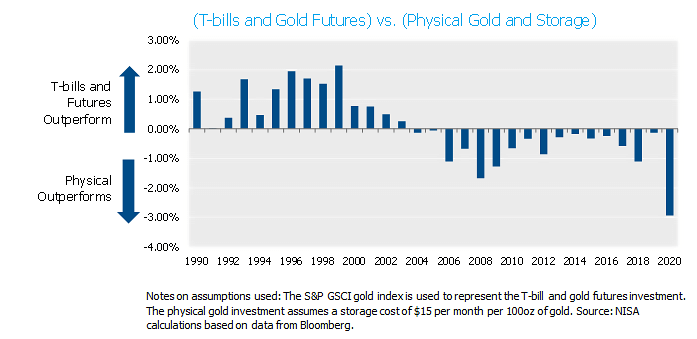

The comparison is as simple as this: How does the performance of buying physical gold and paying for the cost of storage compare to buying T-bills and going long a gold futures contract (and rolling it when required). If the futures price is exactly consistent with the time value of money (the interest rate on the T-bill) as well as the storage cost, then there will be no difference in performance. The history is quite interesting:

The performance of obtaining gold exposure via futures contracts went from being decidedly better than physical gold pre-2006, to being decidedly worse post-2006. Recent history would suggest the more cost-effective way to obtain gold exposure has been to actually purchase the physical gold. This method has been ~80bp per year better than futures for the last 15 years! For those interested in gold exposure and have the cash to fund it, we think a physical investment should be strongly considered.

This performance discrepancy can be understood if the price on gold futures contracts is “too high.” That is, it is either pricing in a time value of money that is above prevailing interest rates, or a storage cost that is above the actual amount. This brings up a second opportunity – the cash and carry of gold.

The “Midas Touch” on Cash

You have heard us talk about Cash and Carry before as it relates to U.S. Treasury bonds and futures contracts.

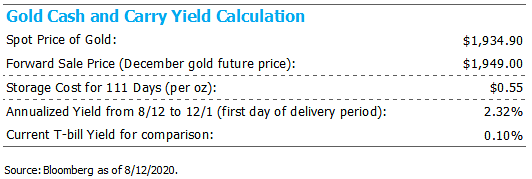

Very analogously, a cash and carry trade applied to gold involves the physical purchase of gold, while at the same time locking in the sale price of it at a forward date via a futures contract. As with all cash and carry trades, this eliminates any exposure to the price of gold itself, and establishes the rate of return available on the invested cash. Again, if the futures price is “too high” relative to the spot price of gold, then a rate of return above T-bills can be earned on your cash. This is in-fact the case, and as of the drafting of this note on 8/12/2020, the economics of a gold cash and carry is as follows:

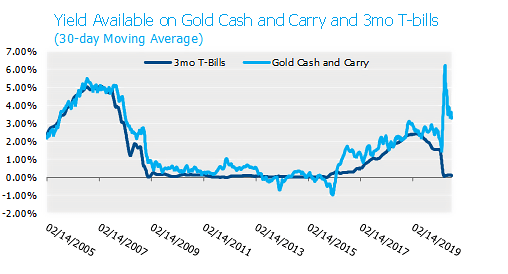

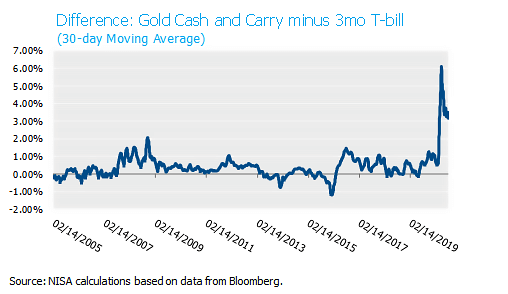

Instead of investing any idle cash in a T-bill, this example shows how a spread of 222 bps over T-bills can be earned by a cash and carry in gold for the next 111 days. The discovery of opportunities like these in the market may be as rare as discovering gold itself. In fact, the chart below shows our calculations for the historical time series of the yield available on the cash and carry of gold compared to that of T-bills. It can be seen that only recently has this opportunity presented itself in such a sizable way.

Gold has a melting point, but is it Liquid?

We’ve left out some of the mechanics on implementing a physical gold position, but we would be happy to get into these details for those interested.[1] A detail we think is important to recognize, however, is the liquidity of a physical gold position.

We think one of the easiest ways to cash-out a physical gold position is to deliver it into a futures contract. For example, even if you had a cash and carry trade implemented on the December contract, but wanted to liquidate your position in September, you could do so by doing the following[2]:

- Cover your short position in the December contract (go long an offsetting amount of December futures).

- Short a September futures contract and immediately give notice that you will deliver your physical gold into the short position.

- The delivery process settles two days later and the position will be fully liquidated at that point.

To be sure, in such a liquidation there is no assurance the initial spread over T-bills will be earned as the exit price on the physical gold via the September contract doesn’t need to be the same as what was locked in at inception on the December contract.

The Silver Lining

At this point, some of you may be asking if there is a similar story for the other major precious metal –Silver. The short answer is yes, there is opportunity there as well, although the silver market is not as deep as the gold market. Further details and data are available upon request.

[1] For example, the vaulting of gold is surprisingly straightforward given the infrastructure put in place by the exchange (CME Group) and its delivery procedures.

[2] FYI, there are listed futures contracts for every month of the year, so this liquidation process is not constrained to a particular calendar cycle of delivery months.