A terrifying specter has reappeared in the darkest corners of the Eccles building. For the first time in 40 years, the Federal Reserve faces a material risk that inflation expectations could de-anchor and cause high inflation to become entrenched in the U.S. economy. Like a toddler afraid of the boogieman in the closet, the Fed fears the de-anchoring prospect despite the lack of evidence that it exists. That terror has spurred them along to the second most aggressive policy tightening in their century-long history and will likely spook them into maintaining restrictive policy long after realized inflation has begun to fall.

We’ve Seen This Movie Before

Economists at the Fed and elsewhere generally accept that inflation expectations drive realized inflation outcomes, through two primary channels:

- If consumers expect high inflation in the future, they will demand higher wages to protect their real income. This could potentially start a cycle of self-reinforcing wage-price spiral that exacerbates inflation.

- Inflation can gather momentum as firms find it easier to raise prices in an environment where inflation is high and prominent in the public discourse.

Once those dynamics become entrenched, the cost to breaking the cycle and restoring low inflation expectations becomes very high. This is exactly the process that unfolded in the 1970s when Federal Reserve Chairman Arthur Burns declared premature victory in the fight against inflation. The subsequent de-anchoring of expectations led to wage-price spirals and realized inflation that peaked at 14.8% in 1980. The Great Inflation crisis was not resolved until Chairman Paul Volcker imposed two very harsh recessions. Even then, it took the better part of two decades to restore the Fed’s credibility on low and stable inflation.

Monitoring Expectations: Surveys

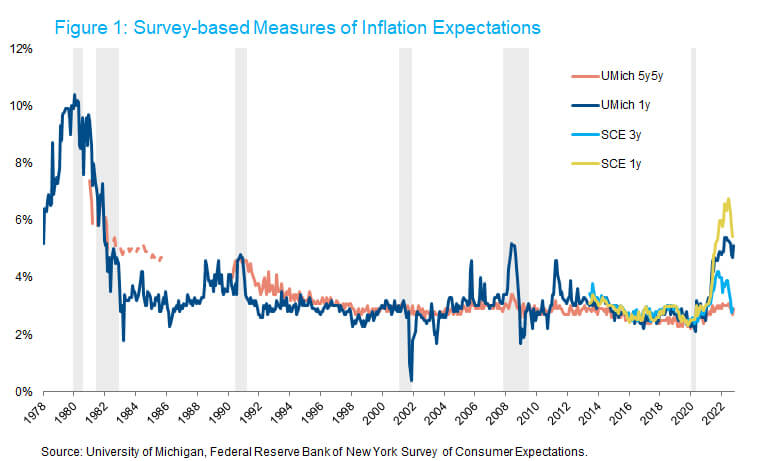

The Fed devotes an enormous amount of effort to monitoring inflation expectations. They closely follow the many surveys of business and consumer inflation expectations, as well as market-based measures. The University of Michigan has published a widely-followed survey of consumer inflation expectations since the 1970s. We find several flaws with the Michigan survey, but it is the only data source that measures inflation expectations back to the Great Inflation. As you can see in Figure 1, inflation expectations were quite elevated at that time over both the 1-year horizon and the 5-year horizon, five years forward.

That historical experience contrasts favorably with the current Michigan survey results showing an increase in 1y expectations but no concurrent increase in 5y5y expectations. The New York Fed’s Survey of Consumer Expectations (SCE) was developed in the last decade with state-of-the-art survey design methods that are more robust to the biases that infect other surveys. The SCE results also show a similar pattern where near-term expectations have risen significantly more than medium-term expectations.

Monitoring Expectations: Market-based Measures

We prefer market-based measures of inflation expectations, from the Treasury Inflation-Protected Securities (TIPS) market and inflation derivatives. These measures of inflation compensation are more robust than surveys because investors have more than $1.8 trillion of skin in the game (whereas the cost of being wrong on a survey is $0 and five minutes of your time). A breakeven inflation rate is the difference between the nominal yield on a traditional Treasury and the real yield on a TIPS with the same maturity. The rate is called a “breakeven” because it is the inflation rate that would have to be realized over the life of the bond in order to make an investor indifferent between owning TIPS or nominal Treasuries.

TIPS are generally less liquid than nominal Treasuries. That liquidity differential varies widely over time and can reach extreme levels during periods of market dysfunction like October 2008 and March 2020. The relative illiquidity of TIPS puts upward pressure on real yields relative to nominal yields, so the liquidity premium reduces the level of breakevens. Breakevens also include an inflation risk premium, which is the compensation that investors demand to protect against the risk that realized inflation deviates from their expectations. Investors demand a higher yield to bear inflation risk, so the inflation risk premium generally puts upward pressure on breakevens. It is also a component of the nominal term premium on Treasury securities. As is typically the case throughout financial markets, these risk premia are inherently unobservable – the best we can do is estimate them.

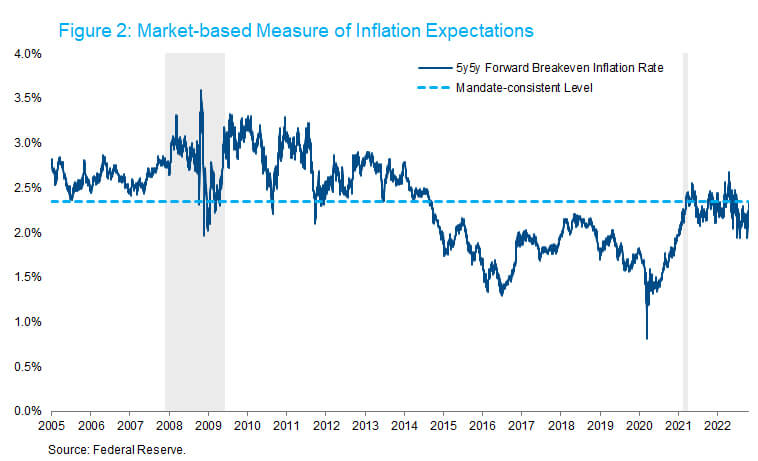

The good news is that, despite their various shortcomings, both surveys and market-based measures are telling the same broad story today: near-term inflation expectations are elevated but longer-term expectations remain well-anchored near levels that are consistent with the Fed’s 2% inflation target. The Fed prefers the 5-year inflation rate, five years forward as a measure of long-run inflation expectations because it strips out the cyclical noise from the first few years and is measured between two of the more liquid tenors in the TIPS market. As shown in Figure 2, this measure remains near the 2.35% level that is roughly consistent with the Fed’s mandate (the Fed targets PCE inflation, which historically runs 0.35% below CPI inflation to which the TIPS market is indexed).

The Fed takes some comfort from the apparent stability of long-run expectations, but is well aware of the shortcomings of both surveys and market-based measures. Furthermore, nobody really knows what a de-anchoring would look like. It has only happened once before in modern American history. The economy and the media landscape that informs consumers have changed so much since the 1970s that a de-anchoring today would probably take a different form. Chairman Powell has cited the Potter Stewart doctrine, essentially saying we’ll know it when we see it. We expect that longer-term breakevens would spike in a de-anchoring, but again, the TIPS market didn’t exist back in the 1970s. More importantly, as Chairman Powell is well aware, by the time the de-anchoring is apparent in market prices, the damage is already done.

Into the Twilight Zone

Fear of the “expectations boogieman” is so severe that it has turned the Fed’s reaction function upside down. For the decade after the 2008 financial crisis, the Fed was worried about a downside de-anchoring of inflation expectations. This fear was motivated by a theoretical concern that the zero lower bound on interest rates would prevent the Fed from providing sufficient monetary stimulus to reflate the economy. The theoretical concern was exacerbated by the observed decline in long forward breakevens after 2014 (see Figure 2). That fear prompted multiple rounds of QE and ultimately the Fed’s adoption of the flexible average inflation target. The “risk management” mantra at the Fed in those days was to err on the side of letting the economy overheat in order to prevent a downward de-anchoring of inflation expectations. Today the Fed has the opposite problem, and they are acting like it. The new risk management approach is to err on the side of imposing a recession in order to prevent an upward de-anchoring of inflation expectations.

This approach appears to be working so far, but the job is far from complete. The longer the realized inflation remains elevated, the greater the risk that expectations de-anchor. All are hopeful that inflation will peak soon and begin to fall. Even when that happens, we expect that the fear of the boogieman will inspire the Fed to maintain a more restrictive policy stance than would otherwise be the case. They’ll be keeping a close eye on the available measures of expectations as they guard against a de-anchoring, but those only provide a limited degree of comfort as discussed above. Signs of a true de-anchoring would probably be obvious to all, but by then it’s too late. The Fed will have lost the war against inflation as they did in the 1970s, and it will probably take another 25 years to restore their credibility and re-anchor expectations at an acceptable level. If Chairman Powell allows that to happen, he will join Arthur Burns in the Fed’s hall of infamy. Given those prospects, we’d probably be scared of the dark too.