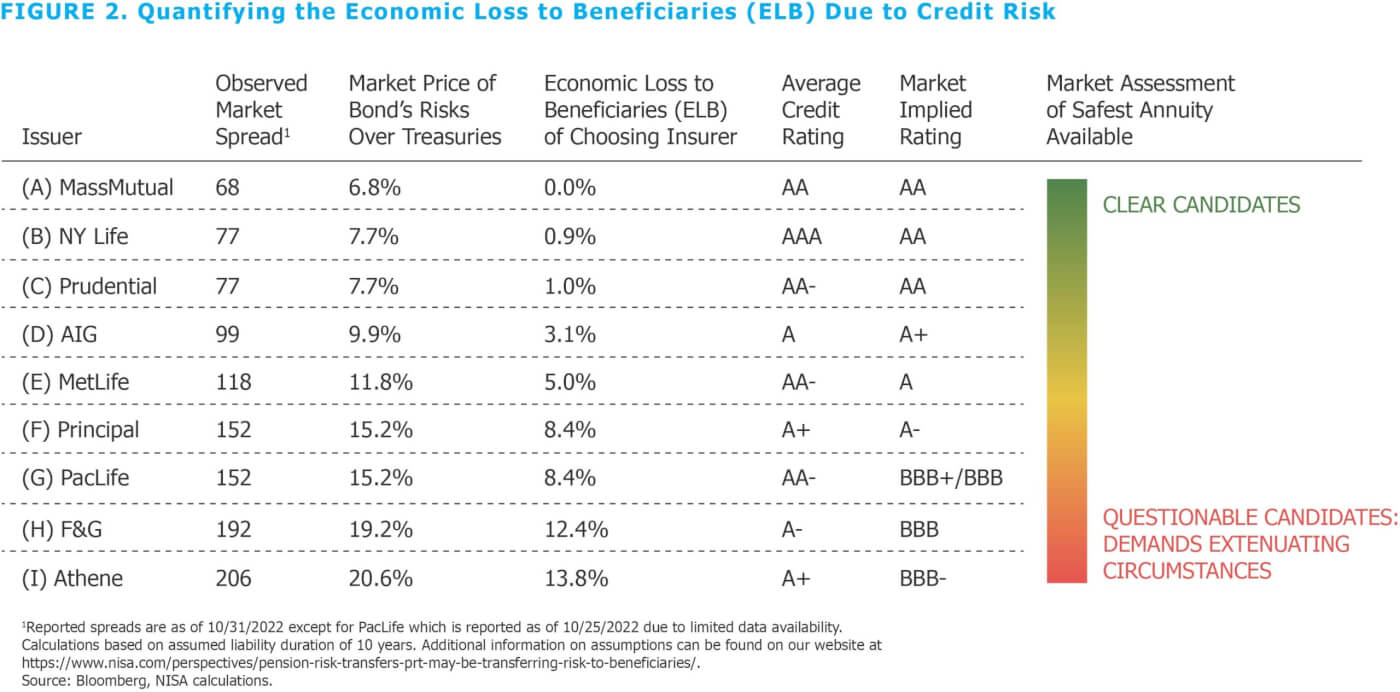

Year-end is often accompanied by an uptick in Pension Risk Transfer (PRT) transactions. Accordingly, we are updating our estimates of the potential ELP associated with commonly used insurers based on current (10/31/22) market pricing. We developed this methodology to aid fiduciaries who are responsible for choosing an insurer as part of PRT transactions. Our ELP formula uses a market-based approach to measure the relative credit risk of insurers who commonly compete to sell annuities to pension plan managers. By examining the credit spread on publicly traded, policy level securities, we can provide a market measure of each insurer’s default risk. Similar to our initial findings, the range of credit risk among insurers is quite striking.

Depending on the selected insurer, we estimate that beneficiaries risk losing as much as 13.8% of the value of their pension in the form of uncompensated credit risk. That is, for a $1b PRT transaction, beneficiaries are at risk of an economic loss of as much as $138mm.

A detailed description of the methodology can be found in our paper “Pension Risk Transfer May be Transferring Risk to Beneficiaries.”