Economic and Market Overview

August 2025

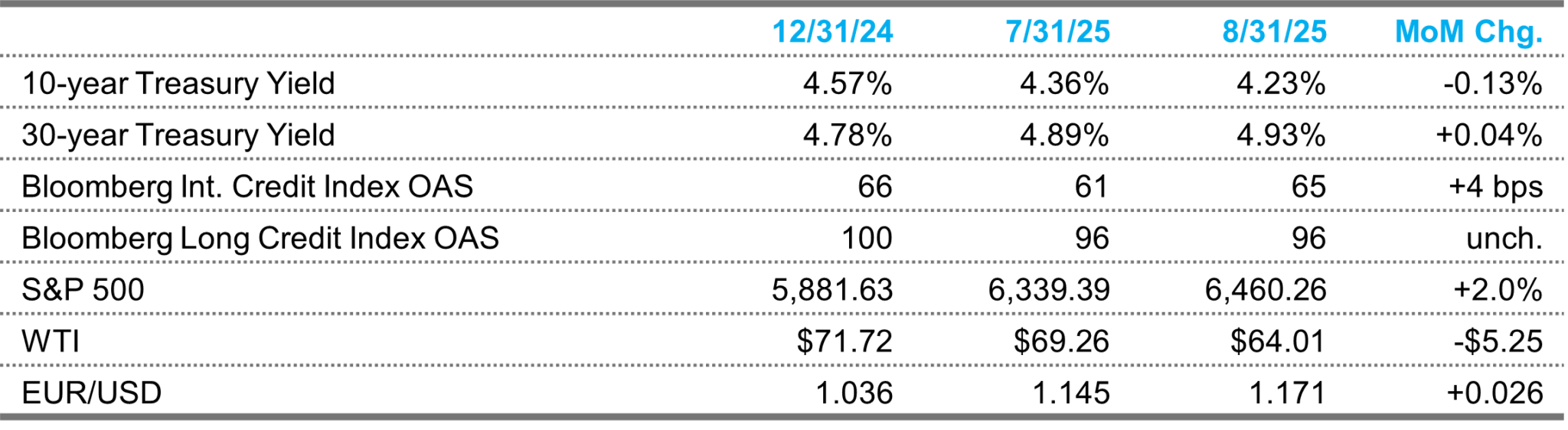

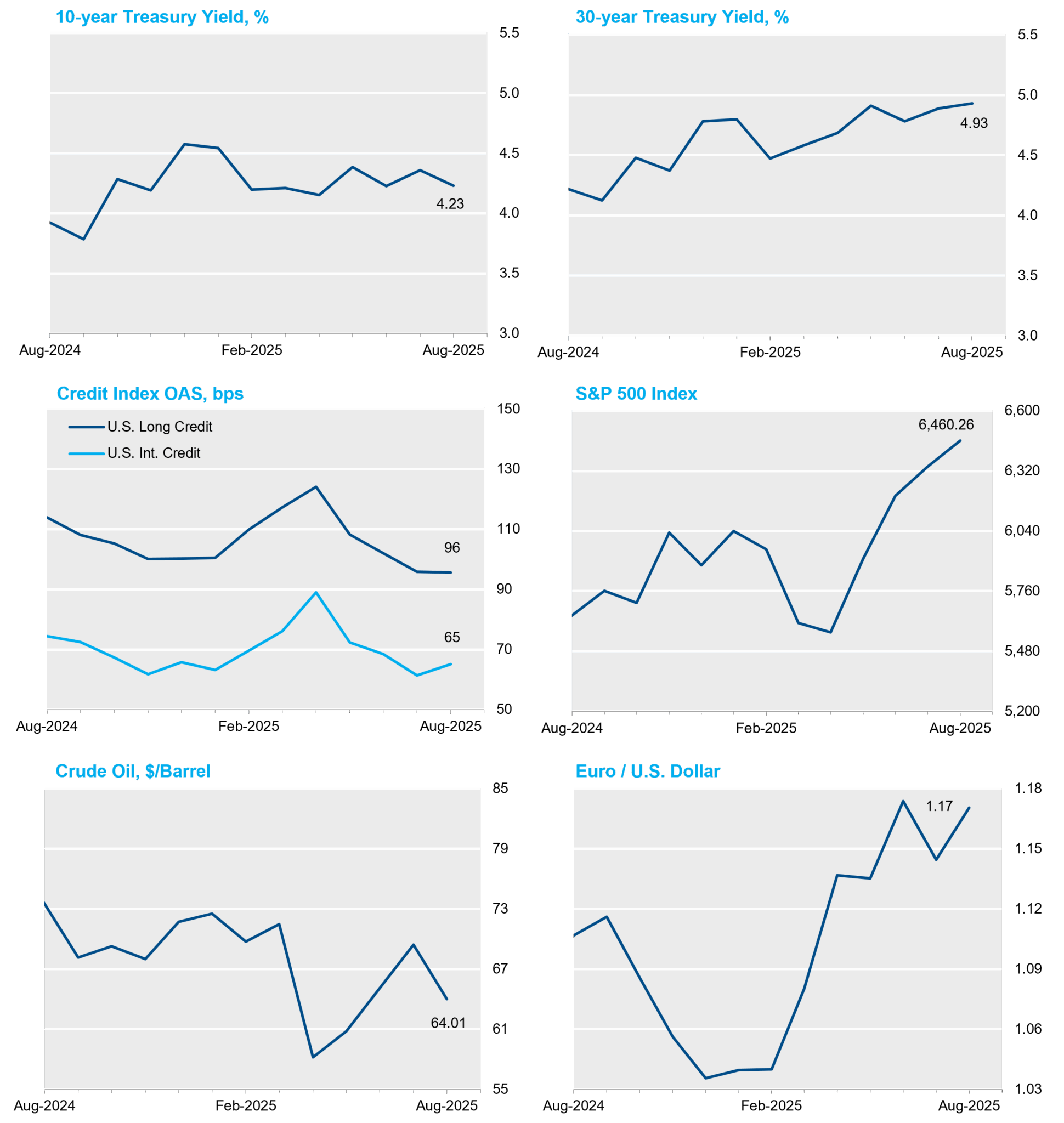

Federal Reserve officials increasingly signaled an imminent rate cut as employment data disappointed. Equity markets powered ahead, but credit spreads ultimately failed to follow suit and the yield curve steepened due in part to concerns over threats to the independence of the U.S. central bank.

Markets

While the S&P 500 fell on the final trading day of August, it closed at a new all-time high a day earlier ultimately returning 2.0% for the month. Small caps fared much better as the Russell 2000 returned 7.1%. Treasury yields rallied at the front end and sold off at the tip of the curve as cracks appeared in the labor market and the Fed’s independence faced increasing threats from the White House (see below). Intermediate credit spreads widened and long spreads finished where they started but only after the average OAS on the Bloomberg Long Credit Index touched 90 bps for the first time since the 1990s. J.P. Morgan reported $99 billion in total investment-grade issuance for the month, 6% over the average of the prior four Augusts. Oil fell as the summer driving season came to an end and OPEC+ accelerated increases in output. The Dollar Index posted its seventh monthly decline in eight chances this year, falling by 2.2%.

Economic Data

The month began with a bombshell when nonfarm payrolls rose by just 73k. This reflected a 31k miss, but more disappointing news arrived via 258k in net downward revisions to the prior two months marking the largest such adjustments since March/April 2020. The unemployment rate was less disappointing as its 0.1% increase to 4.2% was in line with consensus. Economists predict that August nonfarm payrolls growth will come in at a 75k rate and the unemployment rate will tick up by 0.1% when data are released on September 5. Early in the summer, consumers did not seem fazed, at least according to retail sales data, as July figures were broadly in line with consensus and prior months were revised higher. Looking ahead, however, both major consumer indices indicated more confidence about present conditions versus expectations. Measures of sentiment for manufacturers and the services sector were mixed, as were housing data. U.S. GDP’s Q2 rebound from Q1’s 0.5% decline was revised 0.3% higher to 3.3% according to the second release, as the contributions of both personal consumption and business fixed investment were upsized. Forecasters expect around a 1.5% rate for Q3.

Inflation

Core CPI rose 0.3% in July, in line with expectations of the highest monthly pace since January and the second highest in the prior 16 months. Although tariffs still influenced the data, it was at a slightly slower pace than in the prior month and instead driven mainly by services. Producer Price Index data came in red hot as the headline and core indices jumped by 0.9% MoM, both of which were 0.7% over surveys. Headline and core PCE inflation rose by 0.2% and 0.3%, respectively, both of which matched surveys. Inflation expectations increased for the near term as 2- and 5-year breakevens finished 11 and 4 bps higher at 2.75% and 2.52%, respectively, while longer tenors barely budged.

Federal Reserve

The FOMC did not meet during August as they decamped for their usual Jackson Hole conference. Communications generally leaned dovish after July’s payrolls report, and Chairman Powell’s keynote speech in Wyoming raised expectations for a 25-bp rate cut at the next meeting in September. As tariffs pass through to prices more slowly than expected, a majority of FOMC officials have seemingly judged that the downside risk to the labor market has risen enough that they no longer have the luxury of waiting for clarity on the inflationary effects. As of month end, short rate markets were pricing slightly more than two 25-bp rate cuts over the three remaining 2025 meetings. Overshadowing the routine debate about the near-term monetary policy outlook, the Trump administration escalated its attacks against the central bank by accusing Governor Lisa Cook of mortgage fraud and attempting to remove her from office.

Sources: Bloomberg Index Services Ltd., Bloomberg.

This overview is for informational purposes only. The information has been obtained from sources considered to be reliable, but the accuracy and completeness are not guaranteed. There is no assurance that any economic trends mentioned will continue or that any forecasts will occur. Economic data are as of the dates noted.

Disclosure Information

By accepting this material, you acknowledge, understand and accept the following:

This material has been prepared by NISA Investment Advisors, LLC (“NISA”). This material is subject to change without notice. This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) NISA is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, (iii) that you are capable of understanding and assessing the merits of a course of action and evaluating investment risks independently, and (iv) to the extent you are acting with respect to an ERISA plan, you are deemed to represent to NISA that you qualify and shall be treated as an independent fiduciary for purposes of applicable regulation. NISA does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein. You may not rely on the material contained herein. NISA shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of NISA except for your internal use. This material is being provided to you at no cost and any fees paid by you to NISA are solely for the provision of investment management services pursuant to a written agreement. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a client of NISA and (ii) the terms contained in any applicable investment management agreement or similar contract between you and NISA.