The Update

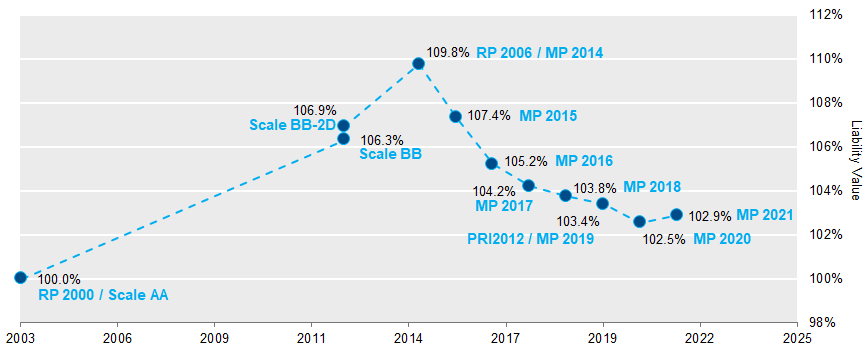

In October, the Society of Actuaries (SOA) released mortality Scale MP-2021, giving us another opportunity to quickly reflect on the impact of mortality assumptions on pension valuation and management.

For all points on this chart, we have modified our own input assumptions since our last SOA mortality scale update post to assume a 50/50 blend of male/female accrued benefits. We assume retirement at age 65 and start with a generic plan with a duration of 15 using RP-2000/Scale AA. Mortality assumptions are scaled to 2022 and liabilities are discounted using the FTSE Pension Discount Curve as of October 31, 2021.

- Since the last October release in 2020, which would have seen plans using Pri-2012 with MP-2020, our sample plan sees a modest 30-40bps increase in liability.

- Since the peak of longevity optimism with scale MP-2014 on what are now called the RP-2006 tables, the sample liability is down about 6%. And in the 18 years since the adoption of RP-2000, the annualized increase in liability values due to longevity improvements has been 16bps.

- As noted in prior posts and announcements, we continue to believe that participant-level mortality assumptions which use factors not incorporated in the standard tables will prove valuable to many plan sponsors. They may shed more light both on overall plan liability estimates as well as those relevant to subpopulations of the plan for which various cost-benefit analyses may be performed (partial or full buyouts, lump sum offers, hedge analytics). NISA continues to work with plan sponsors on this topic, and we welcome and encourage conversations related to it.

COVID-19 Impact

At this stage, the most recent standard SOA mortality table and scale do not incorporate any COVID data or adjustments, as the latest population data used is through 2019. The impacts of COVID-19 are still unfolding. Data is still being generated and analyzed, making estimates of COVID’s impact on even realized mortality harder than it might first seem. Estimating its impact on future mortality is even more uncertain. That said, our friends at Club Vita have provided us with data that has helped us estimate that, through 2021, the impact of excess mortality due to COVID thus far has brought the average corporate pension liability down less than 50bps. Individual plans may have had different experiences relative to the average plan. Similarly, because this figure excludes forward-looking effects, when all is said and done, COVID may have a different overall impact on pension plans that is as yet unknown. Club Vita also provides an estimate of how different assumptions on the forward-looking effects may impact pension values. They illustrate a range bookended by a liability reduction of ~4% on the low end to an increase of ~1% on the high end as plausible outcomes.