Many pension plan sponsors and fiduciaries are confronting perhaps the most important decision in the plan’s life – whether to pursue an internal de-risking strategy or pay an insurer to offload the liability. We highlight some key considerations for those faced with this choice, and explore the components of the amount a sponsor may pay in a buyout transaction.

Though the full details of last year’s landmark pension buyout deals remain largely undisclosed, one fact is abundantly clear – many plan sponsors of all shapes and sizes are eager to decide for themselves whether annuitization is the right solution for managing pension risk.

The allure is obvious. Paying to hand over the assets and liabilities has a turnkey simplicity that many CFOs may find appealing as they search for ways to insulate the company from the risks of the pension plan. However, below the surface of that apparent simplicity are complex questions that each sponsor will confront before any decision can be reached. How will the liquidity drain of a buyout impact the company? How good are the internal alternatives at reducing pension risk? Should longevity risk factor into the decision? How transparent and fair is the annuity pricing? What residual risks may remain after the transaction? The questions pile up quickly.

This paper aims to provide plan sponsors and fiduciaries with a starting place for addressing these complexities as they attempt to answer the buyout question for themselves. It is, essentially, a list of pros and cons comparing annuity buyouts to holistic LDI solutions from the perspective of a plan currently managed in a more traditional approach. Different sponsors will likely find certain comparisons more relevant to their de-risking objectives than others. For example, sponsors whose primary goal is to reduce the pension plan’s volatility on the company’s balance sheet may find LDI solutions substantially similar to buyouts.

The De-Risking Spectrum

Before delving into the pros and cons, it will be helpful to briefly summarize the three broad pension risk management paradigms outlined in our recent paper, Defining the De-Risking Spectrum1. These three modes, “return-seeking”, “hibernation” and “buyout” will be the reference points for our comparison.

- Return-Seeking: The allocation of plan assets is designed to out-earn the liability at an acceptable level of risk. The asset allocation choice is generally the largest contributor to overall risk. Tactical views on interest rates may also be taken to leave some portion of the liability unhedged. Annual funded status volatilities in this mode can range from as low as 4% to higher than 25%.

- Hibernation: Plan assets are predominantly committed to fixed income-based LDI to limit funded status volatility. Volatilities in this range can potentially be reduced to about 1% annually.

- Buyout: Purchase of annuity contracts to completely remove the obligation from the sponsor’s books. Pension funded status volatility is eliminated from the sponsor’s perspective.

Components of Annuity Buyout Pricing

For a hypothetical pension plan with a current accounting funded status of 80%, the all-in price of an annuity buyout will be driven by a handful of conceptually distinct components. Teasing out these separate costs is a key part of comparing buyout solutions to alternatives.

First, the sponsor will need to eliminate any funding deficit versus the corporate-discounted liability with an immediate contribution. For many plans, this may be the largest expense component, and perhaps the most transparent and well-understood.

Second, the liability itself may be revalued from an actuarial perspective. Cash flow projections may be revised to reflect up-to-date actuarial life expectancies, to the extent the current valuation is based on older assumptions. This revaluation likely will increase the size of the liability and imply a larger contribution to reach what the insurer deems to be “fully funded.” The insurer may also review benefit structures and incorporate the actuarial impact of any lump sum offerings that may be offered in conjunction with the annuity purchase. To the extent these considerations are not reflected in the current liability estimate, adjustments may be required.

Third, embedded in the pricing of the annuity is likely to be an amount derived from the transfer of longevity risk. While still a nascent market in the US and elsewhere, it’s generally assumed that pension plans pay to offload this risk in a buyout transaction. Conceptually, this can be thought of as the insurer building in a profit margin for bearing the risk via some “padding” above and beyond the forecasted cash flows provided by the latest actuarial projections. Curiously, the pension plan’s longevity risk can hedge the mortality risk of a life insurance book, which can be one of the major contributors to the enterprise risk of an insurer. Perhaps if competition increases for large buyouts, some insurers (e.g., those with a large life insurance business) may be willing to pay the pension plan for their longevity risk, rather than the other way around.

Lastly, insurers will likely revalue the liability at a discount rate that allows them to purchase, in their opinion, a portfolio of sufficiently low risk assets to satisfy the liability and make a profit from the transaction. Treasury yields provide a useful reference point for this pricing component as the valuation will likely fall between the corporate bond discount curve and a Treasury curve. For every basis point insurers value the liability above Treasuries in pricing annuities, they must purchase riskier assets in an effort to satisfy the liability and be willing to accept a net return lower than that of other market participants for the same assets (since some of the asset’s risk premium has effectively been conveyed to the plan sponsor by accepting the liability at a higher than riskless discount rate). The price of the buyout will include the additional amount required to increase the assets to match this new liability valuation based on a discount rate below the corporate bond discount curve.

Pros and Cons

The comparison beginning on the next page assumes the perspective of an underfunded pension plan currently in return-seeking mode which is choosing between an LDI-based hibernation strategy and an annuity buyout. While we have attempted to identify some key considerations plan decision-makers face, individual plans will certainly need to modify them based on their specific circumstances. For example, contributions and liquidity may be of less concern for a well-funded plan or for a sponsor with plenty of cash on hand. Some may also find it appropriate to further define degrees of each pro/con in more detail than is captured in our “stoplight” graphics. Ultimately, in reaching a decision, each sponsor may weight various considerations differently, potentially leading to different choices among seemingly similar entities. For example, the attractiveness of removing the plan from the corporation’s balance sheet may trump other considerations, while some may determine that retaining the plan is acceptable so long as funded status risk and contribution uncertainty are reduced.

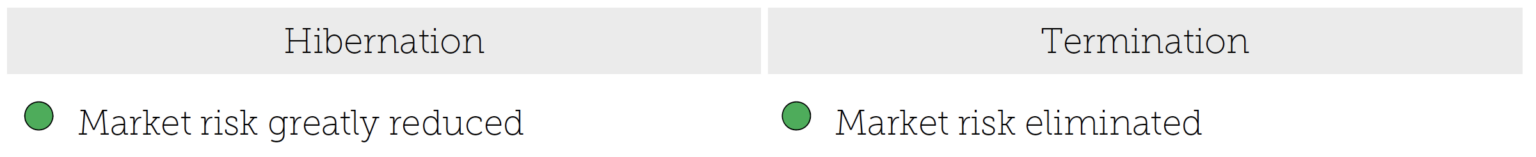

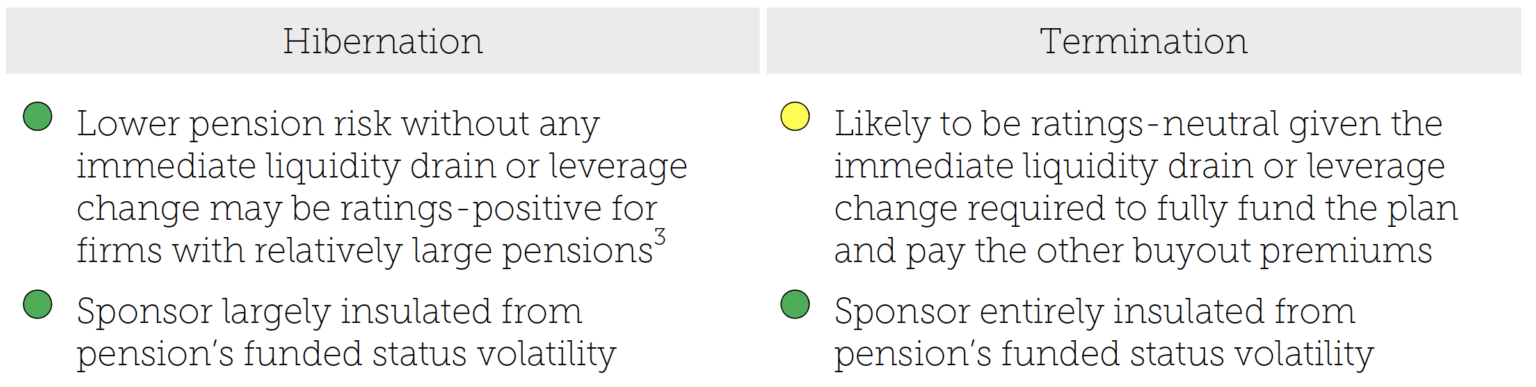

Market risks

Funded status volatility can be reduced to as low as 1% in hibernation mode, which is a small fraction of a typical plan’s current volatility2. If the primary goal is to reduce the pension plan’s risks derived from equity markets and interest rates, hibernation likely satisfies that objective.

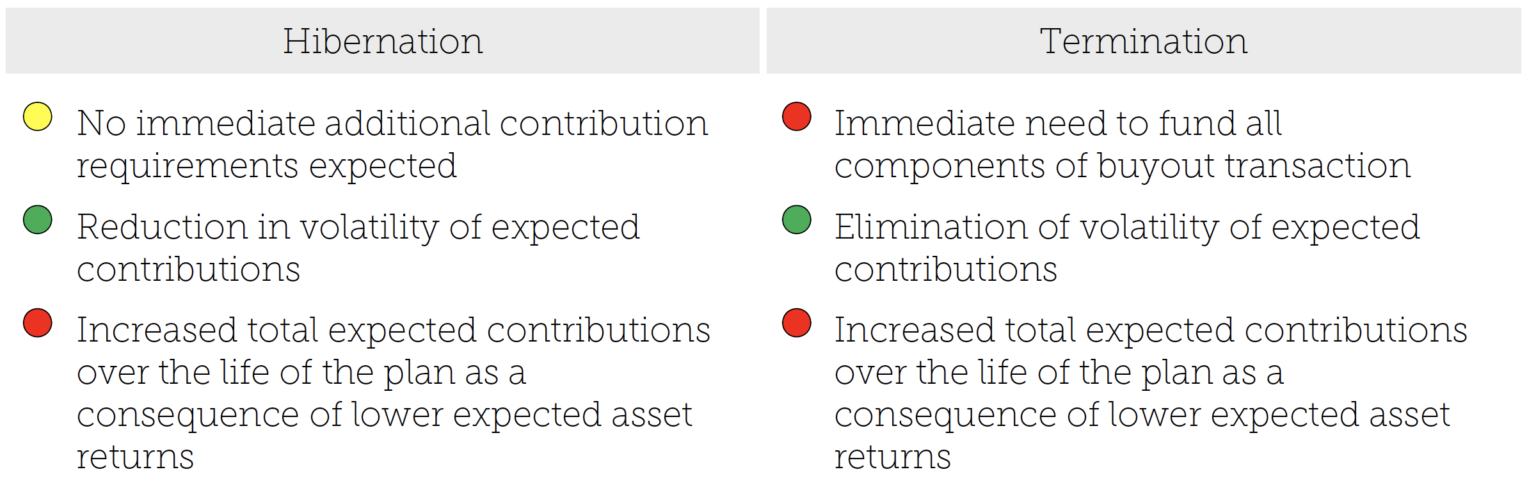

Contributions and liquidity

A buyout requires an immediate cash contribution whereas a hibernation solution does not. In both modes, future contribution volatility may be greatly reduced as a result of the reduced market risks affecting funded status. However the reduction in expected return on assets implies a higher expected contribution total over the life of the plan, compared to return-seeking mode.

Sponsor health and credit rating

As Moody’s was quick to point out following the announcement of the GM deal4, the risk-reducing benefits of a pension annuity buyout may be offset by the required cash infusion. However, hibernation solutions can provide the benefits of reduced risk without requiring any immediate additional contributions – even suggesting an improvement in sponsor credit rating in some cases.

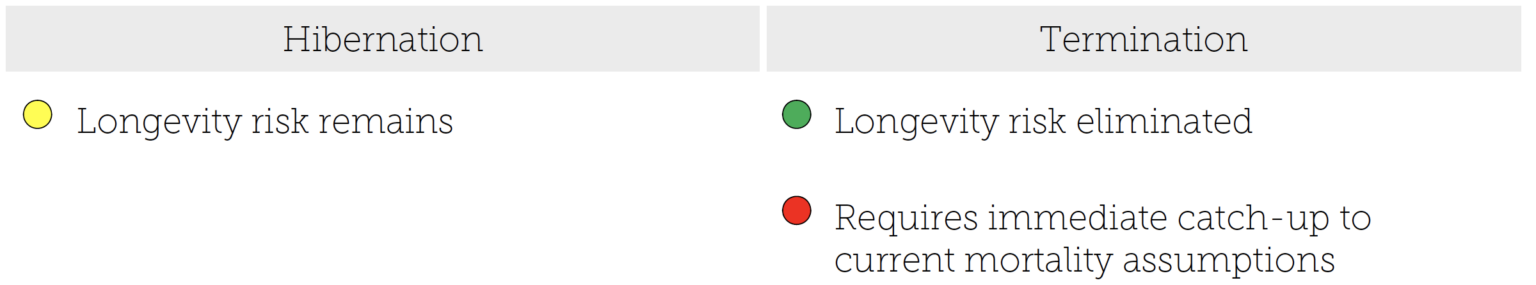

Longevity risk and mortality assumptions

We estimate longevity risk to be small relative to other plan risks, and therefore not likely to justify a buyout on its own. Our recent analysis estimates longevity risk to be about 0.4% annually in funded status terms.5

Separately, the question of whether the plan’s current liability value is based on outdated mortality assumptions is relevant. A plan will be forced to immediately recognize any “stale” assumptions in a buyout transaction, but may be able to delay this recognition for accounting and funding purposes in hibernation mode.

Separately, the question of whether the plan’s current liability value is based on outdated mortality assumptions is relevant. A plan will be forced to immediately recognize any “stale” assumptions in a buyout transaction, but may be able to delay this recognition for accounting and funding purposes in hibernation mode.

Conflicts of interest in insurer selection

The sponsor decides whether to terminate, but the fiduciary chooses the annuity provider. While pricing is likely to be a key factor in the sponsor’s decision, the fiduciary is charged with selecting the safest available provider without considering pricing as a primary criterion. One could imagine a situation in which the safest available annuity provider is charging a notably higher price. The fiduciary may be obligated to choose this provider, potentially undermining the sponsor’s initial analysis of the costs and benefits of termination.6

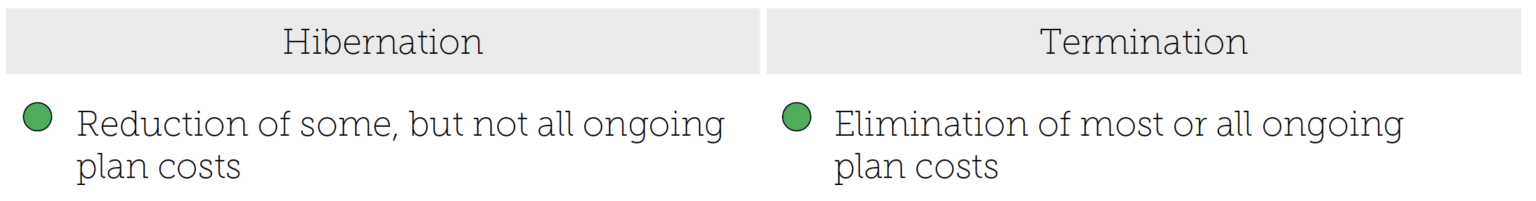

Ongoing plan costs

Some plan costs (e.g., administrative and management costs) may be substantially reduced in a hibernation solution. With the assets primarily dedicated to liability hedging, the fiduciary’s management role is likely to be simpler without the complexities of overseeing a broader portfolio across many asset classes. Most or all of these costs will be eliminated in a buyout scenario (though any structuring or advisory costs should not be overlooked). If the hibernation solution is based on a fully-funded plan, PBGC variable rate premiums (i.e., the “underfunding charge”) would be eliminated, for example.

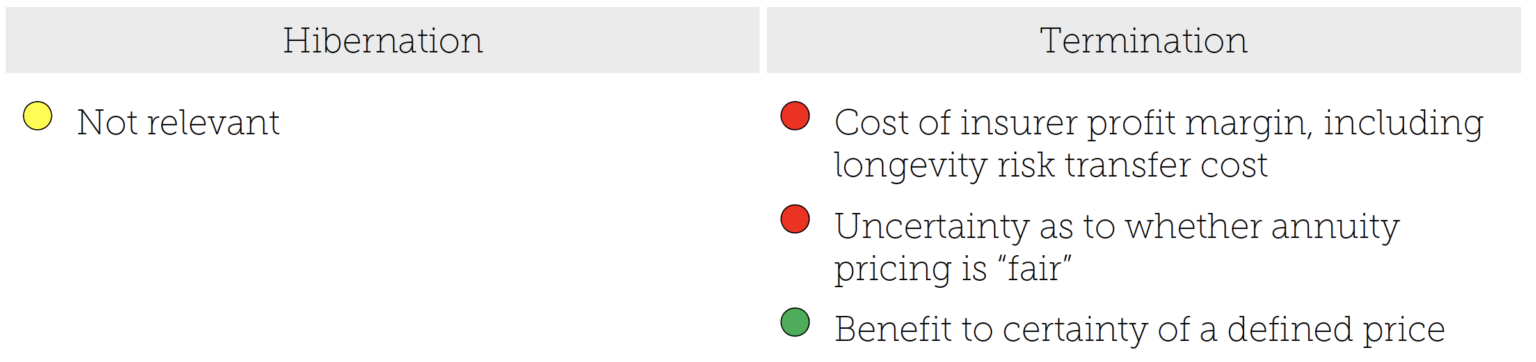

Insurer profit margin and pricing opaqueness

The pricing of a buyout transaction will naturally include some profit margin for the insurer, representing a cost for the sponsor. The narrowness of the annuity provider market, the relative dearth of comparable transactions for large plans, and any uncertainty regarding the various pricing components may lead a sponsor to question whether pricing of an annuity buyout is transparent and competitive. However, some sponsors may find value in the certainty of having a single, defined price tag associated with their de-risking solution.

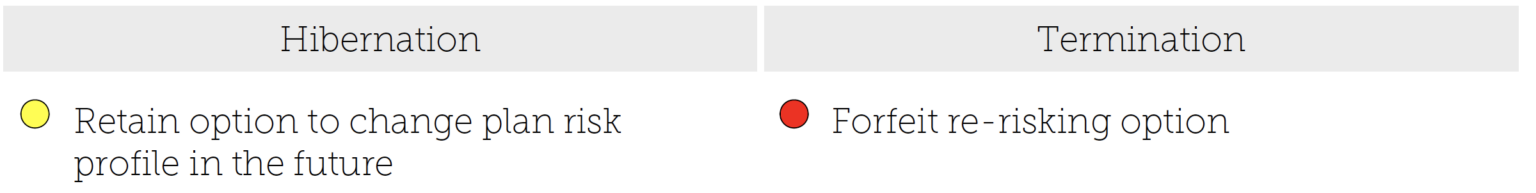

Flexibility option

One important option the plan fiduciary possesses is the ability to adjust the risk profile of the plan to reflect changing market conditions or new risk/return preferences. A hibernation solution allows the fiduciary to make changes to “re-risk” the plan in the future, whereas a buyout solution is obviously a permanent decision that removes the fiduciary’s influence over the asset allocation going forward.

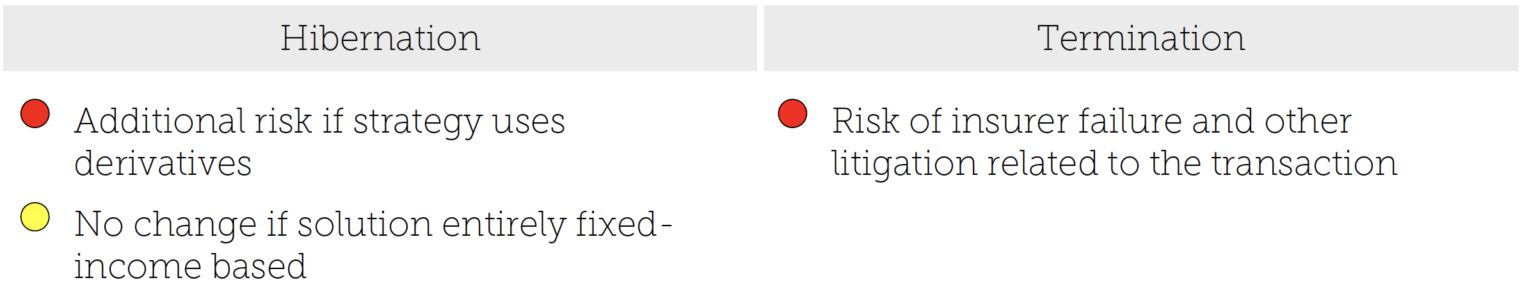

Counterparty and litigation risk

A hibernation solution may utilize derivatives to provide a hedge to market risks (e.g., interest rate and equity market risks) not otherwise hedged by the assets themselves. Whether using over-the-counter swaps or centrally-cleared derivatives, this may introduce new counterparty risks to the plan. An entirely fixed-income based hibernation solution may not require derivatives, but may require additional contributions for an underfunded plan seeking to minimize tracking error versus the liability.

A related type of counterparty risk may also exist in the selection of an annuity provider. In the event of an insurer failure, will the sponsor and fiduciary be entirely insulated from liability? Additionally, recent lawsuits show that sponsors should be prepared to defend their decisions in court even prior to the buyout transaction (though this issue could become less relevant if lawsuits continue to be settled to the sponsor’s benefit).

A related type of counterparty risk may also exist in the selection of an annuity provider. In the event of an insurer failure, will the sponsor and fiduciary be entirely insulated from liability? Additionally, recent lawsuits show that sponsors should be prepared to defend their decisions in court even prior to the buyout transaction (though this issue could become less relevant if lawsuits continue to be settled to the sponsor’s benefit).

Conclusion

The good news for plan sponsors and fiduciaries tasked with choosing a pension de-risking strategy is that they have options. The bad news is that they have options – and choosing between them isn’t likely to be easy, given the multitude of factors to consider.

Further, while we have simplified the choices into the broad categories of “buyout” and “hibernation”, the lines are less clear-cut when considering partial buyouts, annuity buy-ins, lump sum offerings, and longevity swaps that may be utilized in hibernation mode. The choices are also not mutually exclusive. For example, the liability-focused portfolio resulting from a hibernation solution would likely make any eventual handoff to an annuity provider that much simpler.

In reality, those plans seeking to de-risk benefit from having a wide array of tools at their disposal to design a strategy that meets their objectives. Since both buyouts and LDI-based hibernation can achieve similar de-risking results, sponsors may weigh other advantages of each approach and their specific circumstances in making the appropriate decisions for their plans.