Since the start of the pandemic in 2020, the average funded status of corporate pension plans has increased from 84% to 104% as of June 30, 2024.[1] As funded status improved, many plans de-risked by shifting assets from return-seeking to liability-hedging. Early in de-risking journeys, plans generally allocate liability hedging assets to traditional long duration bond portfolios benchmarked to published indices. However, as plans approach being fully funded, they refine their hedge and transition to highly customized dynamic Liability Driven Investing (LDI) strategies tailored directly to the liability.

As plans migrate to custom solutions, costs and complexity need to be weighed against hedging effectiveness. Large plans are able to leverage their scale and partition their liability hedging assets across multiple separate account portfolios, each designed to meet a specific role within the hedging strategy. In contrast, smaller plans may face challenges building highly customized LDI strategies. In this piece, we show that a structure that bundles various components of an LDI strategy, when managed by a manager with both fixed income portfolio management and pension liability expertise, can deliver the same features as fully bespoke partitioned LDI strategies with a lower minimum investment amount and potentially less complexity.

Custom LDI strategies seek to hedge three primary market-related risks of pension liabilities:

- Duration – sensitivity to changes in the level of Treasury rates,

- Spread – sensitivity to changes in the spread component of the liability discount rate, and

- Yield Curve – distribution of the liability’s cashflows across the yield curve.

Large plans often partition their LDI strategy across multiple actively-managed fixed income accounts benchmarked to published market indices and a custom Treasury-based completion portfolio. The completion portfolio is dynamically managed to maintain the target interest rate hedge and yield curve match between the liability and fixed income assets. The actively managed portfolios are typically allocated to credit heavy benchmarks and seek to include managers with relatively uncorrelated excess returns. Often times, the completion manager also manages one of the actively managed credit portfolios to allow for easier adjustments to the blend of Treasuries versus credit within the liability hedging assets.

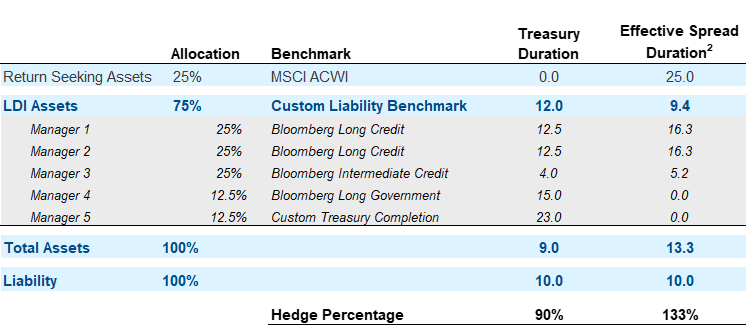

The example below assumes the plan is 100% funded and LDI assets target a 90% hedge of the liability’s Treasury rate exposure through the use of a completion portfolio. Return seeking assets are assumed to not contribute to the liability’s Treasury rate hedge, but do contribute to the liability’s spread hedge. The estimated liability spread hedge from the LDI assets alone is 71%.

Exhibit A: A partitioned LDI structure allows plans to diversify LDI assets across multiple managers

Data sources: Bloomberg, NISA calculations.

This structure addresses each of the liability risks described above and allows a majority of the hedging assets to be actively managed to pursue excess returns and potential funded status improvement, while maintaining funded status volatility at a very low level. Additionally, it allows for benchmarking simplicity as all components of the liability hedging strategy, with the exception of the completion portfolio, are benchmarked to familiar and transparent published indices. The completion portfolio is benchmarked directly to the liability and seeks to minimize tracking error.

This structure can achieve tracking error between the hedge assets and liability as low as 1.5% – 3% depending primarily on the duration of the liability and chosen discounting methodology. There are certainly reasons why a plan may choose not to minimize tracking error of the hedge assets versus the liability, including tactical views on the direction of rates, or incorporating the relationship between return seeking assets and the liability when determining the allocation to credit within the liability hedging assets. The tracking error that remains is almost entirely related to credit spreads, as the completion portfolio reduces the impact of the duration and yield curve related tracking error to nearly zero. Much of the spread-related tracking error is related to nuances of the construction of the liability discount curve and cannot be economically hedged.

Small-to-midsize plans, e.g., plans with less than $300mm in LDI assets, may find it prohibitively expensive, or may be unable, to build a partitioned, multi-portfolio LDI strategy. Managers typically set either a minimum fee or minimum portfolio size to qualify for a custom separately managed account (“SMA”). These minimums reflect factors such as operational costs to manage a separate account portfolio and minimum lot sizes required to trade corporate bonds in sufficient quantity to build a well-diversified portfolio. Therefore, small-to-midsize plans allocate their liability hedging assets across fewer managers; often one or two. Collective vehicles can lower the minimum assets’ hurdle for the actively managed components of an LDI strategy, but the completion component must be an SMA due to its customized nature.

Several managers offer suites of LDI pooled vehicles designed to hedge pension liabilities that target specific yield curve segments or key rate duration profiles. Theoretically, plan sponsors could blend these funds to create a reasonably effective LDI solution at a relatively low cost. However, this places the burden of monitoring the portfolio and liability on the plan sponsor, including the required ongoing allocation adjustments to maintain a close hedge versus the liability.

Managers that excel at both liability risk management and active credit fixed income portfolio management can create holistic LDI strategies with features similar to partitioned LDI. For example, a custom LDI portfolio that bundles proprietary actively managed credit collective funds with a custom Treasury-based completion component can be a highly effective, turnkey, liability hedging solution.

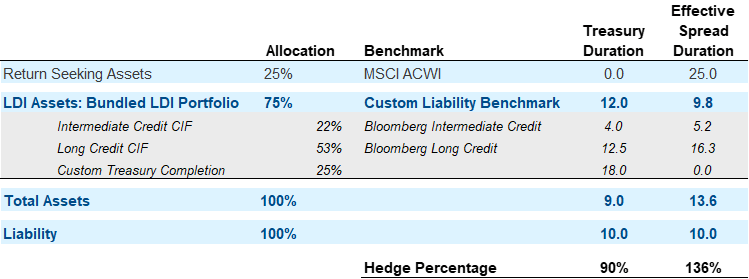

The example below assumes the plan is 100% funded and LDI assets target a 90% hedge of the liability’s Treasury rate exposure through the use of a Bundled LDI Portfolio. Return seeking assets are assumed to not contribute to the liability’s Treasury rate hedge, but do contribute to the liability’s spread hedge. The estimated liability spread hedge from the Bundled LDI Portfolio alone is 73%.

Exhibit B: A custom Bundled LDI approach provides a highly effective pension hedge

Data sources: Bloomberg, NISA calculations.

Bundled LDI simplifies the management of a custom LDI strategy by reducing the decisions a plan sponsor must make to just two:

- Hedge objective – for example, match the duration of the liability or extend the duration with Treasury futures to target a higher hedge target.

- Allocation to credit – the amount to allocate to credit is driven by a number of factors including the allocation to return seeking assets, the discount rate used to value the liability, and the tradeoff between funded status risk and expected return.

Once these decisions are made, the manager is responsible for periodic adjustments and rebalancing to maintain the stated hedging objectives.

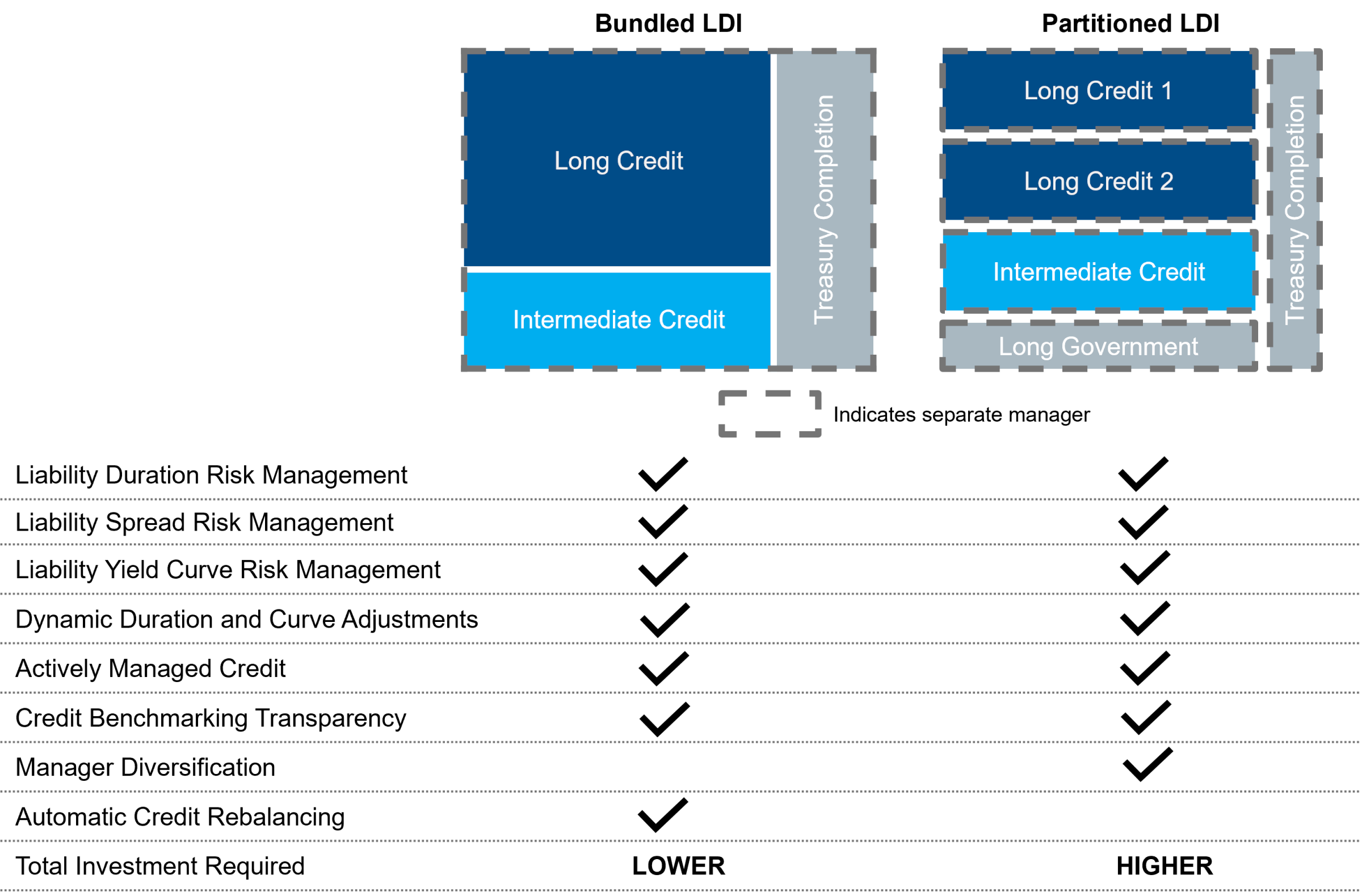

Exhibit C: Bundled LDI and partitioned LDI provide similar liability hedging characteristics

A Bundled LDI portfolio can be structured to have similar market exposures and liability hedging characteristics as a partitioned LDI structure. Additionally, Bundled LDI allows plans to take a relatively “hands-off” approach, as the manager is responsible for ongoing adjustments to the components of the LDI strategy to maintain the hedge objectives. Of course, the hedging objectives should be revisited periodically as plan circumstances change.

The primary drawback of a Bundled LDI approach versus a partitioned LDI approach is lack of manager diversification. Because the LDI assets are allocated entirely to one manager, it doesn’t allow for potential improvement in tracking error from allocating the actively managed fixed income assets to multiple managers with uncorrelated streams of excess returns. However, this is less meaningful if the Bundled LDI manager follows a risk-controlled, low tracking error portfolio management approach.

The manager of a Bundled LDI solution not only needs to be a highly skilled asset manager, but also needs to have deep experience and expertise understanding pension liabilities. The single largest source of market risk in most pension plan liabilities is sensitivity to Treasury rates. Often, plan provisions can have a material impact on the Treasury rate sensitivity of the liability, e.g., lump sum optional form of payment, cash balance features, grandfathered benefits, etc. Depending on the circumstance, this can result in the effective duration of the liability being substantially different from what would be calculated based on static projected cashflow. Mis-estimating the effective duration in this way may have serious consequences on the long-term effectiveness of the hedge.

As plans have migrated to highly customized LDI solutions over the past several years, large plans have led the way in innovation by creating multi-manager structures that provide a very tight hedge of the liability while allowing a majority of the fixed income to be actively managed to pursue excess returns in order to keep pace with, or exceed, the growth of the liability. Similar approaches have generally not been available to small-to-midsize plans. However, by bundling the components of an LDI strategy with a single manager, plans can achieve similar LDI outcomes as larger plans in a cost-effective manner. The key to success of such an approach is identifying a manager that can deliver risk-controlled actively managed fixed income performance and is highly skilled at evaluating the nuanced sensitivities of pension liabilities.

[1] Data taken from NISA’s PSRX Index Data which is based on the 100 largest pension plans, as determined by NISA based on publicly available information. The PSRX Index is a forward-looking estimate of the funded status volatility of U.S. corporate defined benefit pension plans. For more information on the PSRX Index go to: https://www.nisa.com/psrx/.

[2] Effective spread duration (“ESD”) is an estimate of an asset’s sensitivity to changes in the spread of the liability. The fact that the credit indices have an ESD that is higher than their duration reflects their higher spread volatility (lower average credit quality) as compared to the liability.