The Case for Separating Interest Rate and Spread Risks

U.S. pension plan demand for long duration corporate bonds has been and is expected to remain at a high level. Nonetheless, some sponsors have delayed implementing strategic corporate bond programs because of tactical views on Treasury yields. Given the ease of managing Treasury duration, this need not be the case.

Pension plans use Liability Driven Investment (LDI) strategies in order to reduce funded status volatility. Changes in funded status are driven by movements in both liability and asset values. Given that changes in the value of the reported liability are caused by changes in the level of general (Treasury) interest rates and/or credit spreads, an important component of these LDI strategies is often a meaningful allocation to long duration investment grade credit (corporate) securities. An allocation to long corporates can help reduce not only the general interest rate volatility of funded status, but also its spread volatility.

Corporate Bond Supply/Demand Dynamics

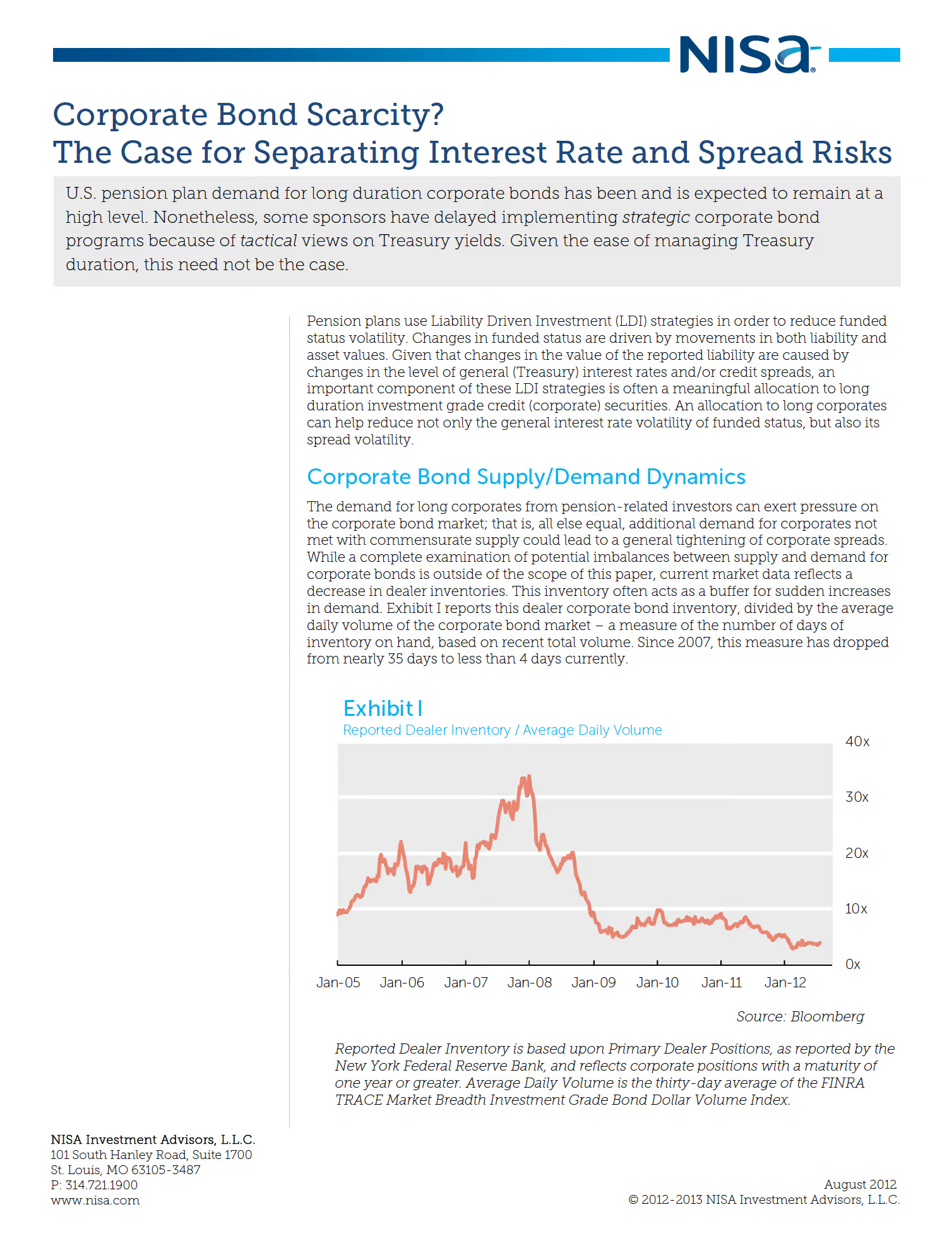

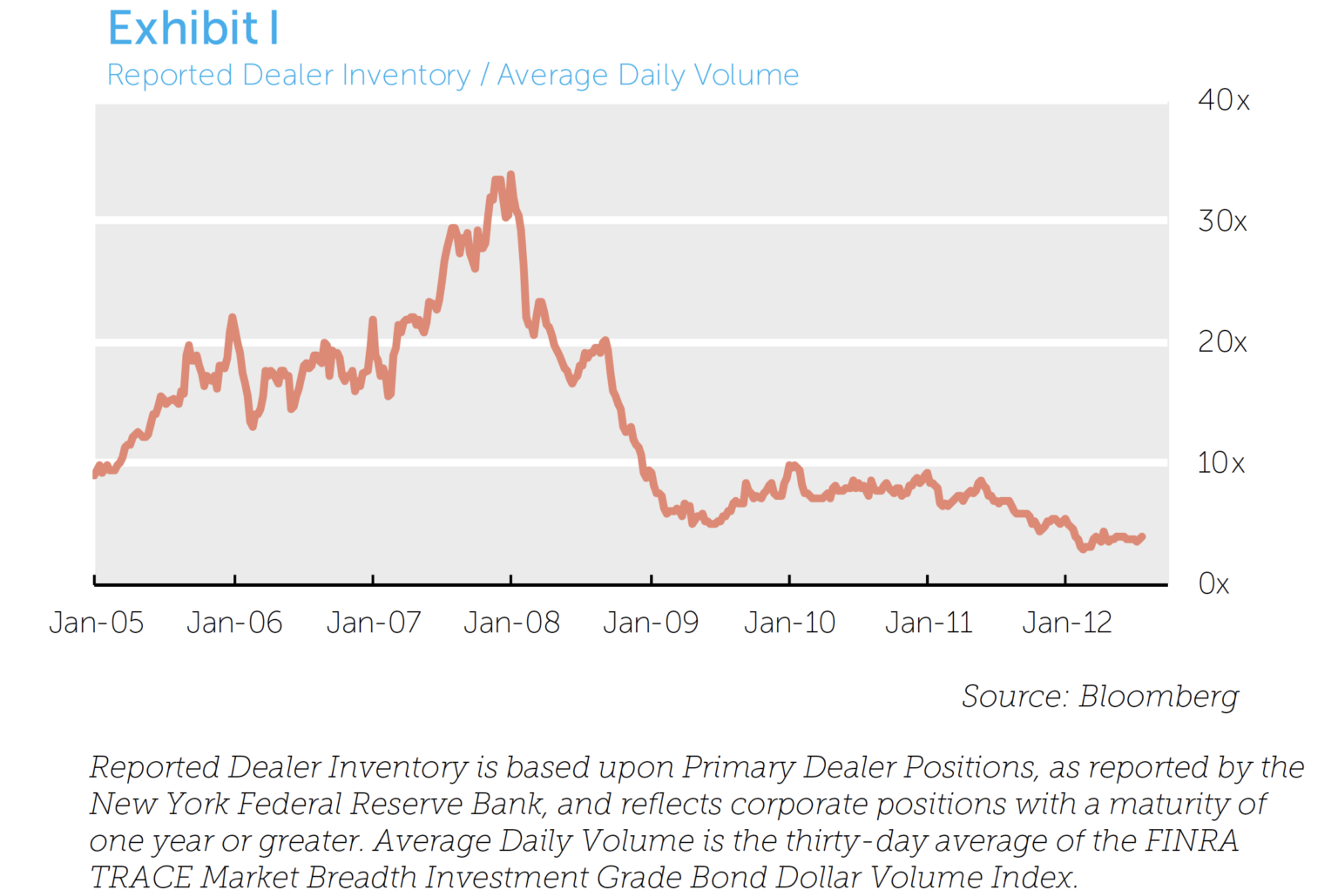

The demand for long corporates from pension-related investors can exert pressure on the corporate bond market; that is, all else equal, additional demand for corporates not met with commensurate supply could lead to a general tightening of corporate spreads. While a complete examination of potential imbalances between supply and demand for corporate bonds is outside of the scope of this paper, current market data reflects a decrease in dealer inventories. This inventory often acts as a buffer for sudden increases in demand. Exhibit I reports this dealer corporate bond inventory, divided by the average daily volume of the corporate bond market – a measure of the number of days of inventory on hand, based on recent total volume. Since 2007, this measure has dropped from nearly 35 days to less than 4 days currently.

Aside from the logical allocation to corporates as part of an effective asset/liability hedge, anecdotal evidence indicates that plan sponsors are certainly aware of the potential supply/demand imbalance within the corporate bond market and, as such, have hastened their interest in credit-based LDI strategies.

Despite the strategic rationale behind corporate bond purchases and concerns over bond scarcity, some fiduciaries are uncomfortable with the general level of interest rates and consequently delay the adoption of a “long duration” strategy. Fortunately, there are ways to combine allocations to long duration corporate securities with synthetic short positions using U.S. Treasury futures, such that the resultant allocation has the desired long corporate spread exposure without the long rate exposure that might not be desired. In this world, sponsors have not only a spread hedge in place – they also have an allocation to (potentially dear) corporate securities.

Similarly, sponsors that already have an allocation to long credit and have a tactical view on the general level of rates need not sell their corporate securities. Rather, they can maintain their allocation to long corporates and its associated spread hedge while reducing their overall general interest rate sensitivity by utilizing a synthetic short position in Treasury futures.

Implementing a Synthetic Strategy

Synthetic short positions designed to remove general rate duration can be implemented in several ways, including with interest rate swaps and Treasury futures. While both can be effective, each has advantages and disadvantages. Our discussion concerns the use of futures.

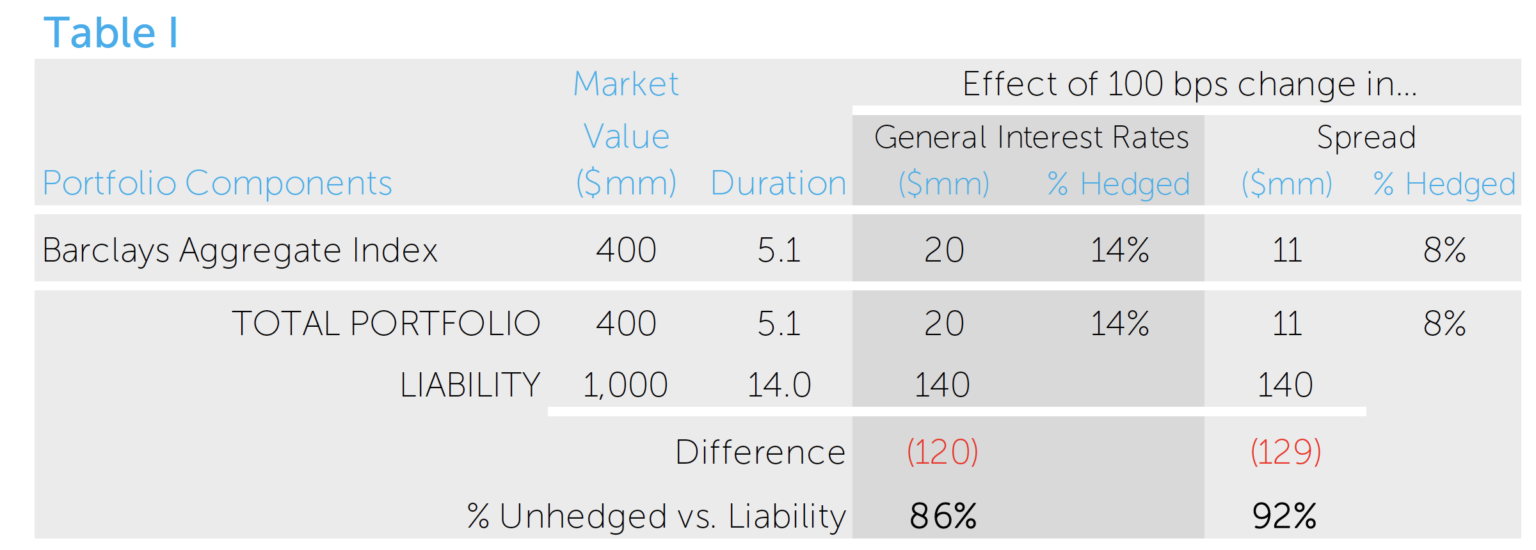

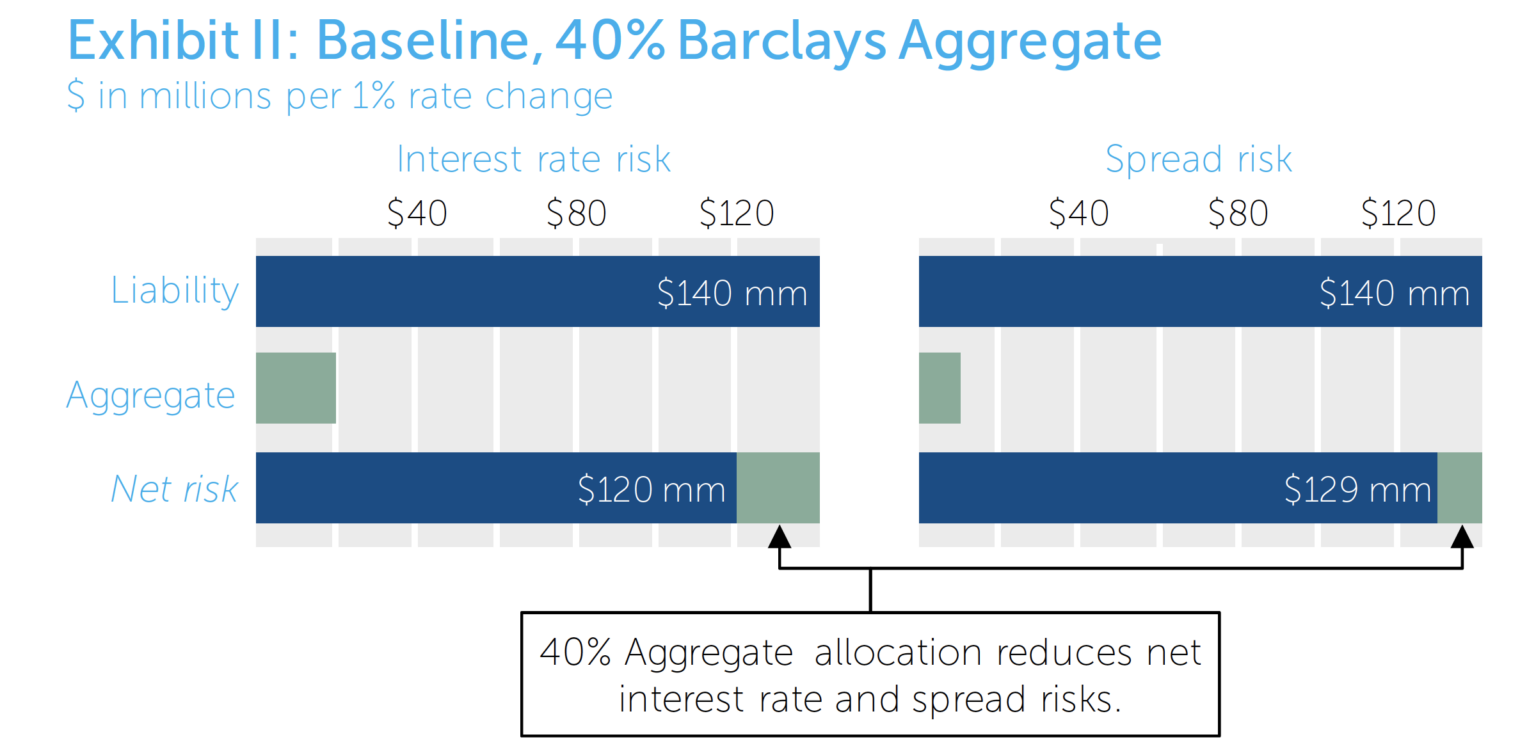

For example, assume a pension plan has a $1 billion liability with a duration of 14 years and $400 million in fixed income assets managed against the Barclays Aggregate Index.

This simple asset/liability profile is outlined in Exhibit II (see appendix for additional details).

In this example, a 100 bps movement in either general interest rates or spreads will change the liability value by approximately $140mm. As such, the pension plan has a general interest rate hedge of approximately 14%, meaning that, all else equal, a 100 basis point change in general interest rates or spreads will lead to a change in funded status of $120 million. Analogously, given the amount of non-Treasury exposure in the Barclays Aggregate Index, the plan has a spread hedge of approximately 8%, meaning a 100 basis point change in spreads will lead to a change in funded status of approximately $129 million.1

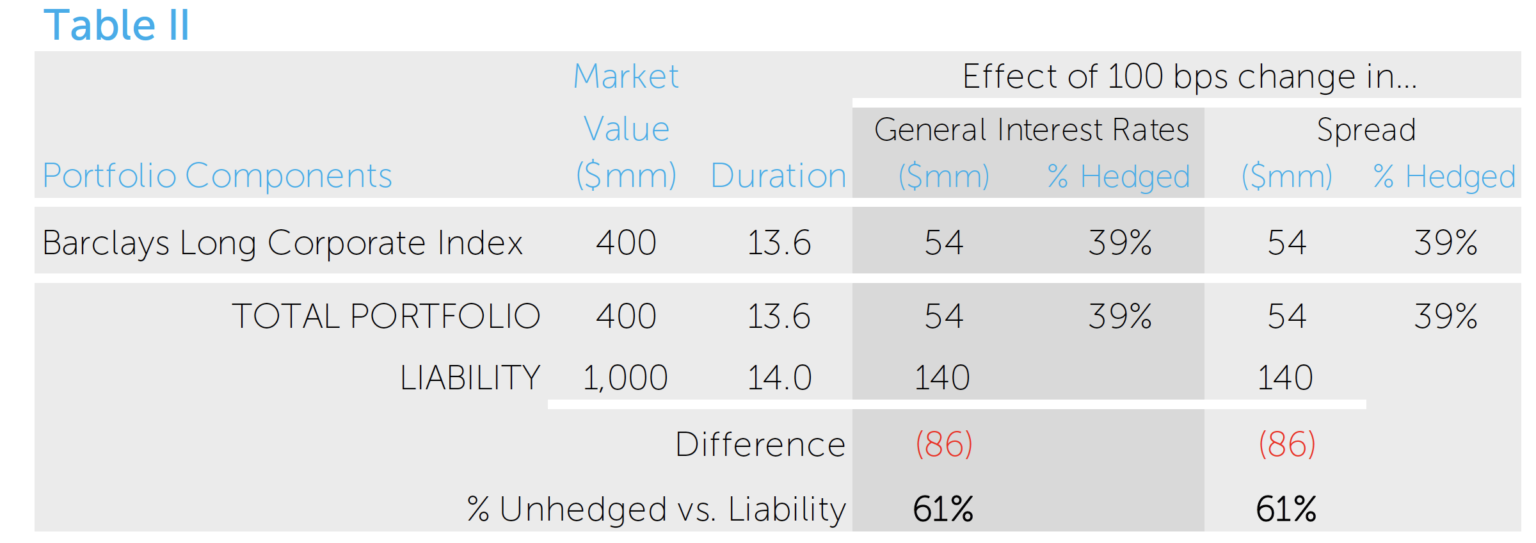

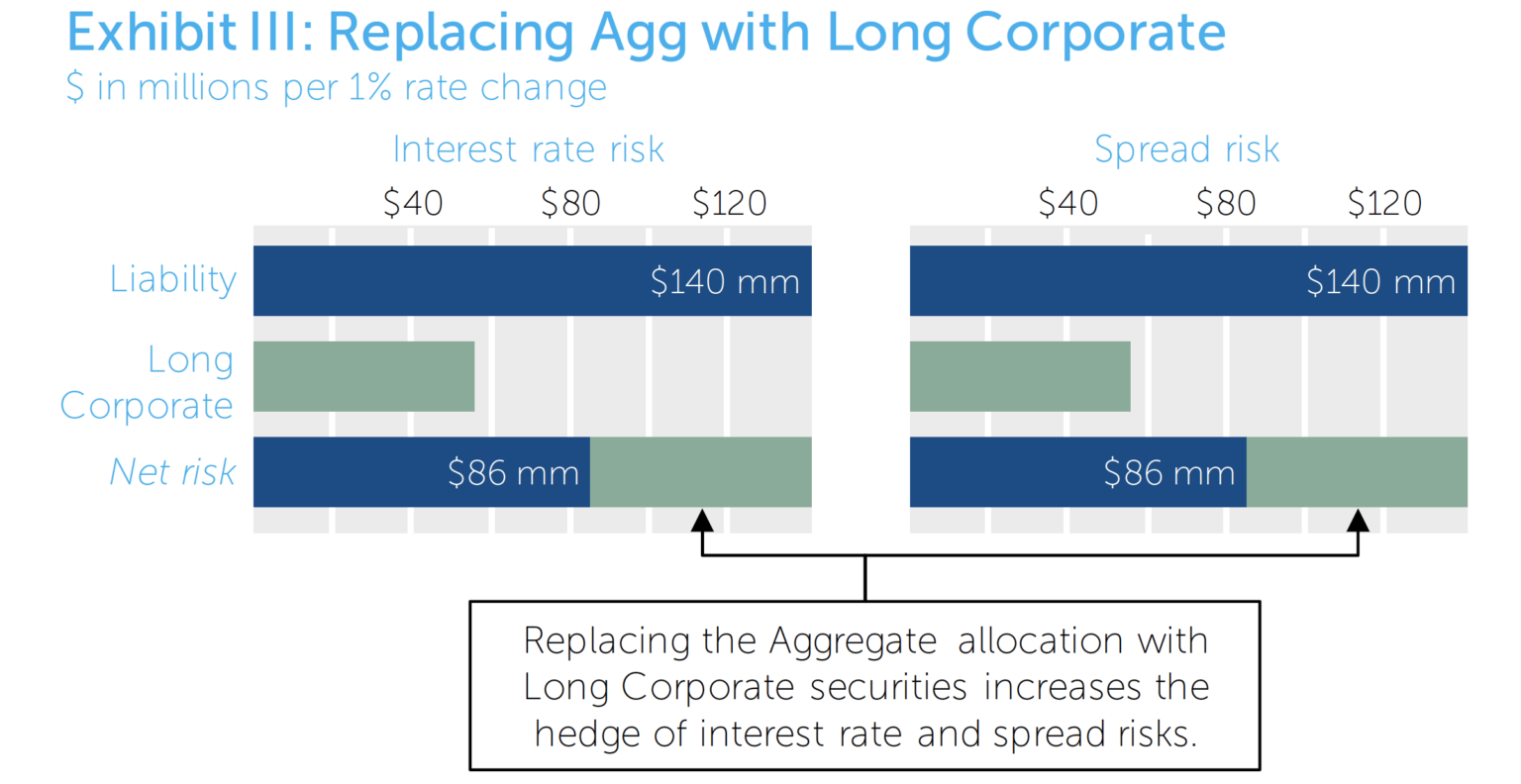

If a long duration strategy were adopted – for example, an allocation to the Barclays Long Corporate Index – the rate and spread hedge would be increased to approximately 39% (or $86 million of interest rate risk remaining) as illustrated in Exhibit III.

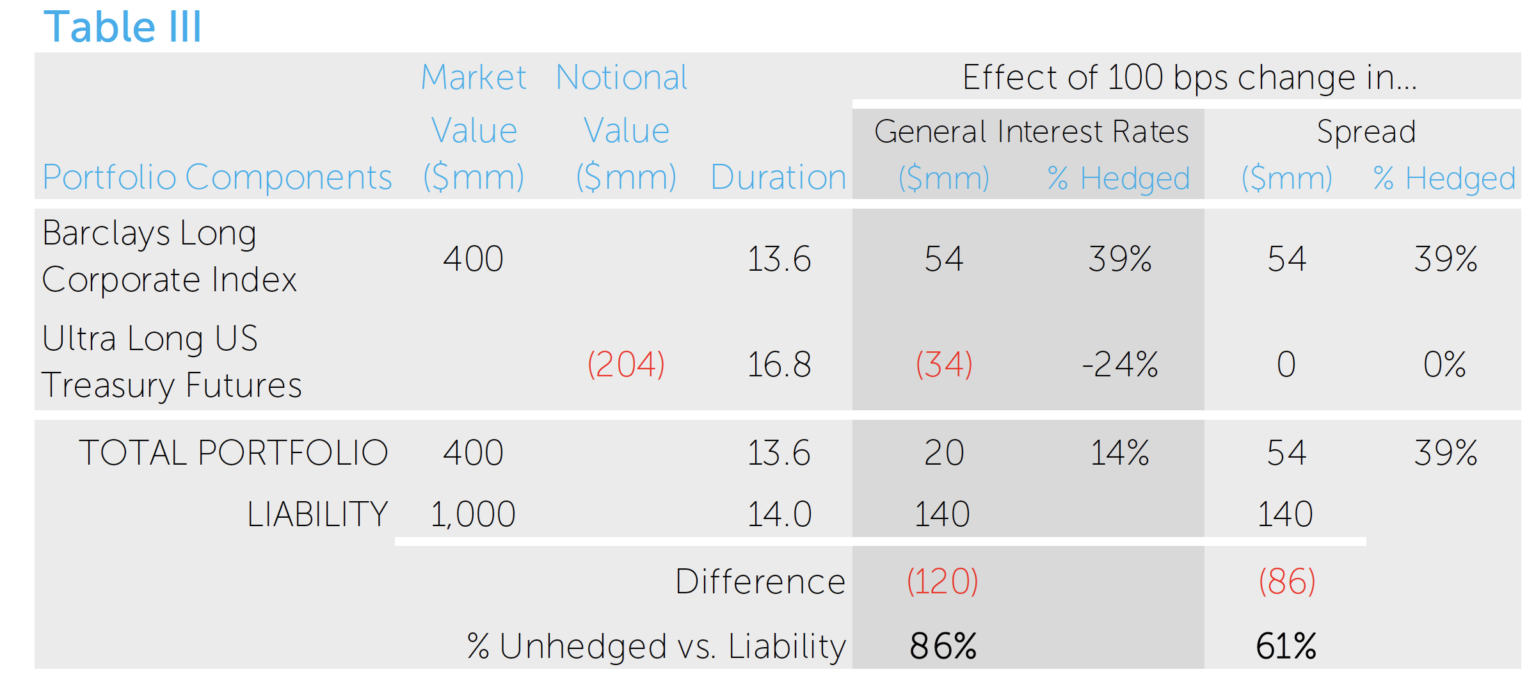

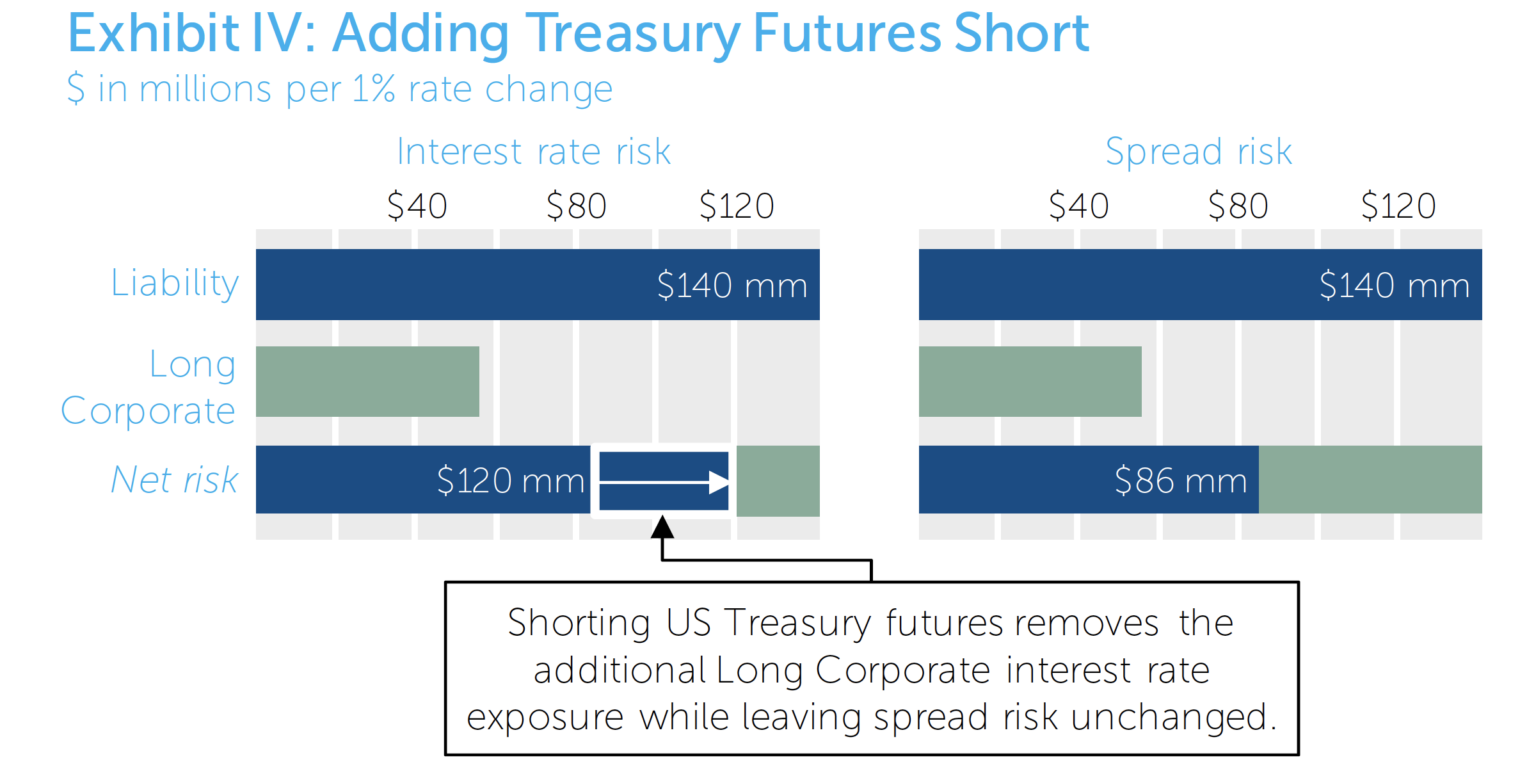

A sponsor that wants the spread hedge of a long corporate allocation and the general interest rate exposure of the Aggregate could use Treasury futures to make the adjustment.

Balancing Strategic and Tactical Views

The purchase of long corporate securities improves the efficacy of the plan’s spread hedge, but does not affect the plan’s overall interest rate hedge when used in combination with Treasury futures. In other words, Exhibit IV reflects an allocation that allows for both strategic hedging views and tactical interest rate views. In addition, this allows the plan sponsor to have an allocation to an asset class that may become dear, should other sponsors continue to adopt similar strategic views.

The use of synthetic financial instruments such as Treasury futures also allows for the easy adjustment of tactical views. For example, increasing or decreasing the size of the tactical short position to a desired target duration can be accomplished easily by selling (buying) more Treasury futures.

Other Considerations

There are five actively traded U.S. Treasury futures contracts, ranging from the Two-Year Note contract to the Ultra Long Term (25-30 year) Bond contract. The analysis above simplistically removed duration by selling the Ultra Long futures contract; a more robust strategy would involve selling additional futures contracts in an attempt to better align cash flows across the yield curve with the cash flow profile of the bond indices involved and/or tactical views. Additionally, interest rate options could be used in place of Treasury futures to introduce interest rate contingent tactical positions.

Operational Details

The use of Treasury futures to shed duration requires posting of Initial Margin, which can be in the form of U.S. Treasury securities. Additionally, the use of futures would require access to cash to satisfy the Daily Variation (Maintenance) Margin requirements. Establishing a separate portfolio of Treasury securities – for example, Treasury Bills – and cash would satisfy these requirements. Based on the numbers outlined in Exhibit IV and using margin requirements and market-based implied volatilities as of July 2012, a separate Treasury/cash portfolio of approximately $30-50 million would be sufficient.

Conclusion

Prospective strategic hedging programs need not be delayed due to tactical rate views; similarly, existing strategic hedging programs need not be unwound due to tactical rate views. Rather, tactical interest rate views can be readily implemented within a broader strategic program by utilizing synthetic instruments to shed the unwanted general interest rate duration. This shortening of plan duration can be accomplished using interest rate swaps or futures.

APPENDIX

Data sources:

- All data are as of June 30, 2012.

- Index characteristics throughout this paper are supplied by Barclays.

- With respect to Barclays’ information stated in this whitepaper – Source: Barclays POINT/Global Family of Indices. ©2012 Barclays Bank PLC. Used with permission. Barclays and POINT are registered trademarks of Barclays Bank PLC.

- This analysis ignores any potential interest rate or spread sensitivity of assets other than fixed income.

- For simplicity, all spread product is assumed to have a beta of 1.0 relative to the liability’s spread.