A volatile September in the normally placid money markets inspired a number of client inquiries, and a few overzealous headline writers in the financial press. In this note we will review what happened, explain why we think it is more likely a technical disruption rather than an indication of broader stress in the financial system, and discuss steps policymakers may take to limit further volatility.

What exactly happened?

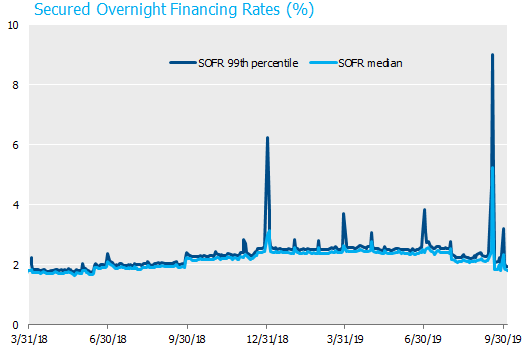

Starting on September 16 interest rates rose sharply in the market for repurchase agreements, or repo. The repo market is an important component of short-term funding markets and the source of financing for dealers’ holdings of Treasury bonds. The New York Fed calculates the Secured Overnight Financing Rate (SOFR) as the volume-weighted median rate of more than $1 trillion daily Treasury repo transactions (SOFR is also the reference rate chosen to replace LIBOR). As shown in the figure below, SOFR rose from 2.20% on September 13 to 5.25% on September 17, while the 99th percentile of repo transactions occurred at 9.00% on the 17th. The spike in repo rates spilled over to other funding markets, causing the federal funds rate to exceed the top of the Fed’s target range of 2.00 – 2.25% on September 17. The Fed responded that week by adding liquidity through a series of $75 billion temporary open market operations (in which the Fed lends cash overnight in exchange for Treasury collateral). These operations helped to calm markets, and borrowing rates had fallen back within the Fed’s target range by September 20. The Fed subsequently announced that those temporary operations would increase in size and term, and continue through mid-November.

Source: Bloomberg.

Didn’t repo market disruptions cause trouble for banks in 2008? Is this latest episode a sign of broader stress in the financial system?

Indeed the inability to roll repo funding did cause a liquidity crisis for Lehman Brothers and other banks in 2008; however, banks stopped lending to one another during the crisis because the uncertainty about toxic asset valuations caused widespread concern about counterparty credit risk. None of that is happening now. We would characterize September’s repo market volatility as a technical issue that can be addressed with straightforward policy adjustments by the Fed. This is not to dismiss the valid concerns of repo market participants, merely to draw a sharp contrast between this episode and 2008.

What caused the volatility in the repo market?

The proximate catalyst seems to have been the confluence of two factors on September 16: corporate tax payments and the settlement of three Treasury auctions. Both of these developments effectively transferred cash from private market participants to the Treasury’s coffers, thereby reducing the supply of lendable funds and driving up the cost of borrowing. These were no surprise: Treasury auctions settle every week and corporate taxes are paid quarterly. A temporary shortage of cash caused by these two factors should not cause repo rates to spike to such extreme levels in a well-functioning market.

Given this, we must also point to latent structural factors that leave funding markets so brittle that a small temporary imbalance between supply and demand can be so disruptive. Chief among these is the stricter bank regulatory regime erected in the wake of the financial crisis. A comprehensive review of regulatory changes is beyond the scope of this article, but we can say with confidence that higher capital and liquidity standards have raised the capital cost of holding repo and other positions on banks’ balance sheets. These higher regulatory standards are imposed through a variety of methods ranging from quantifiable metrics like the Supplementary Leverage Ratio to the more subjective stress tests administered by the Fed each year. Additionally, the 29 banks large enough to be designated Global Systemically Important Banks (G-SIBs) must navigate an even more complex regulatory framework to determine their G-SIB capital surcharge.

As a result of these regulatory changes, banks manage their balance sheets very differently today than they did in the past. Prior to 2008, banks would have responded to a temporary cash shortage by expanding or reallocating their balance sheets to lend cash into the repo market, thereby moderating the spike in borrowing rates. In our opinion, the frictions created by the post-crisis regulatory framework prevent banks from nimbly deploying their balance sheets to profit from short-term dislocations in funding markets. As a result, small imbalances in supply and demand can have outsized effects on money market rates for short periods of time. In the plumbing of the financial system, the pipes have gotten smaller, and are more likely to be clogged by small obstructions. This is not new information. As you can see in the accompanying figure, temporary spikes in repo rates have occurred regularly in the last few years, particularly on quarter-end reporting dates when certain bank regulatory metrics are calculated (especially at year-end when G-SIB scores are calculated). The difference in September was in the magnitude of the spike, and the arrival of the stress in the middle of the month.

What about the supply of bank reserves? Has the Fed shrunk its balance sheet too far?

Reserves are cash that banks hold on deposit at the Fed to fulfill their daily cash needs and satisfy regulatory capital requirements. The Fed can increase or decrease the aggregate level of reserves in the system through its balance sheet policies. The Fed has reduced the aggregate level of reserves from $2.8 trillion in 2014 to $1.4 trillion currently, with the goal of normalizing their balance sheet to a lower level while also maintaining “ample reserves.” Last month’s disruption in the repo market is an indication that the Fed may have removed too many reserves from the system, though no one can be certain of the “right” level of reserves.

What solutions might the Fed deploy to reduce volatility in funding markets?

While the Fed is at least partly responsible for creating the conditions that caused the recent funding market stress, their policy response demonstrates their commitment to maintaining control of their policy rate and generally containing volatility in short-term interest rates. Because the structural fragility of the system was caused by a number of related factors, the Fed is likely to respond with a combination of solutions. They have already announced that they will conduct temporary overnight and term repo operations until mid-November. They will use these temporary operations as needed to ameliorate the funding stress we expect to occur near the end of the year. Chairman Powell also announced on October 8 that the Fed would soon begin increasing the supply of reserves.

However, reserve growth alone may not solve the problem if regulatory frictions prevent those reserves from reaching the borrowers that need them. In that case, part of the solution may lie in reducing balance sheet costs and frictions by revising bank regulations. Regulatory relief takes time and could invite political pressure (perhaps most vocally from the several Democratic senators running for President). If reserve growth alone cannot solve the problem and regulatory relief is unlikely to arrive soon, the Fed has one other tool at its disposal. The FOMC has held discussions this year on creating a Standing Repo Facility (SRF). This fixed-rate, full allotment operation in which the Fed would lend cash via overnight repo would essentially be a standing version of the temporary operations they have conducted in the last few weeks. Because its size would be unlimited, we anticipate that it would represent an effective ceiling on repo rates, even during times of stress. We think an SRF will ultimately become part of the Fed’s operating framework, though it’s not certain they’ll be able to resolve the outstanding operational issues.

Last month’s repo volatility represented a temporary disruption to a market that, by and large, efficiently finances the largest and most liquid market the world, namely US Treasuries. The Fed’s failure to maintain the policy within the target range for a single day, while not particularly consequential for the economy, has evoked a policy response. While these disruptions can present challenges and opportunities for investors in the short term, we have confidence that the Fed and other regulators will take the necessary actions to maintain control of short-term interest rates and support a well-functioning market.