Bond yields have fallen dramatically around the world this month, driven by the latest escalation of the trade war as well as signals that aggressive monetary stimulus will be forthcoming from central banks. Longer-tenor government bond yields in the US and Europe have fallen by 30-60 basis points this month, reaching record lows for many sovereigns.

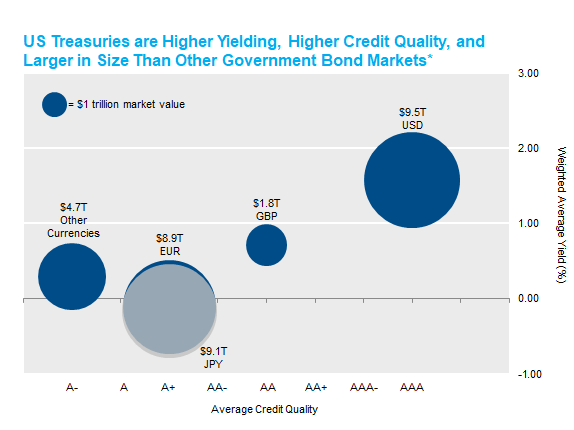

While trade policy risk and the monetary policy response may have catalyzed this most recent price action, it seems to us that fixed income investors are coming to terms with two bigger issues. First, the United States has become an island of yield among a sea of negative interest rates to the east and west. Central bank policy rates are negative in the euro area, Switzerland, Sweden and Japan. German, Swiss and Japanese government bonds are trading at deeply negative yields all the way out to 30- and 50-year tenors.

As a result, US dollar bonds account for 28% of the market value in the Bloomberg Barclays Government Bond Index, but pay out 99% of the yield. This is despite US Treasuries having the highest average credit quality, largest market size and deepest liquidity.

*Universe is the Bloomberg Barclays Government Bond Index.

Source: Bloomberg, as of 8/16/19.

Second, a European economy uniquely exposed to trade is struggling to respond to a cyclical slowdown and political disunity on multiple fronts while at the same time facing material limitations on both monetary and fiscal policy. Exports account for 46% of euro area GDP while global trade volumes appear to be exhibiting a sustained decline for the first time since 2008. The German export engine has been hit especially hard, contributing to a negative GDP print in the second quarter. Brexit continues to drag on, while the possibility of elections in Italy raise the risk of renewed tensions for the European integration project. We expect these tensions to flare up periodically unless Europe addresses the fundamental design flaws of the common currency, including the lack of fiscal union to match the monetary union among a group of nations with divergent economic cycles.

Most importantly from a market perspective, the European Central Bank (“ECB”) has very little ammunition with which to respond to a cyclical slowdown. As the Fed delivered nine rate hikes from 2015 to 2018, the ECB continued easing and currently maintains a policy rate of -40bps. Likewise, the ECB’s multiple quantitative easing programs face procedural or practical limitations on the amount of debt they can purchase. Nonetheless, President Draghi has signaled that he will close out his 8-year tenure by clearing those obstacles and a package of rate cuts and asset purchases as soon as next month. The combination of cyclical weakness, structural flaws and a central bank scraping the bottom of the policy barrel suggest an increased risk that Europe will follow the way of Japan and end up stuck in a quagmire of disinflationary expectations and an ever-growing central bank balance sheet.

From NISA’s perspective, the reality of a global rates market awash in negative yields suggests that US Treasuries may provide some shelter from the storm. With apologies to John Donne, no government bond market is an island unto itself in today’s globalized capital markets. As such, the rising risk that Europe will be stuck in a low-rate paradigm for an extended period suggests that Treasury yields may remain anchored at levels previously thought to be unsustainably low.