We talk with a lot of pension plan sponsors who strategically want to hedge their liabilities by buying long duration corporate bonds but who tactically are discouraged from doing so by low long-term interest rates. In the past we have explored the idea of separating general interest rate and corporate spread exposures when hedging pension risk,* and given some recent market developments we thought it might be a good time to revisit the topic.

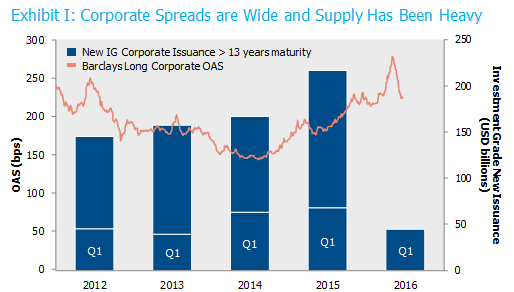

US dollar-denominated investment grade supply, including at the long end of the curve, has been heavy for several years now. Until recently, long corporate spreads had been widening fairly consistently. While fundamental factors certainly have affected spreads (oil moving from $107 per barrel down to $26 per barrel comes to mind!), an additional reason for the spread widening may have been the heavy supply.

Source: Barclays, Bloomberg. Long Corporate OAS is through 3/31/16.

Source: Barclays, Bloomberg. Long Corporate OAS is through 3/31/16.

Long corporate spreads tightened in Q1, and supply was approximately 18% below last year’s pace. Undoubtedly, a “risk-on” environment which began in mid-February contributed to tighter spreads. But something else may be at work here. Has less long-dated corporate issuance been a factor as well? Did foreign central bank accommodation, including the ECB’s announcement that it will purchase Euro-denominated corporates, also add to a spread tightening bias? (That is, will lenders from over there come over here, and/or will borrowers from over here go over there?) More generally, did the US Treasury’s announcement in February that it reduced the size of several auctions, including that of the 30-year bond, affect the appetite of potential long duration investors?

It’s hard to definitively know the answers to these and other similar questions, but the purpose of this post is not to predict the next move in corporate bond spreads or Treasury rates. Rather, it is to remind us that spreads and rates can be separated conceptually and managed independently, allowing for the implementation of both strategic hedging and tactical market views. If sponsors know that a healthy dose of corporate bonds is appropriate for them, low rates should not be a deterrent. It’s easy to hedge unwanted rate risk, and in fact, there may now be additional ways to remove duration to take advantage of other market dynamics.

* Our white paper “Corporate Bond Scarcity?” explored this question in detail back in August 2012.