How the New QLAC Rules Impact a Retirement Driven Investing Strategy

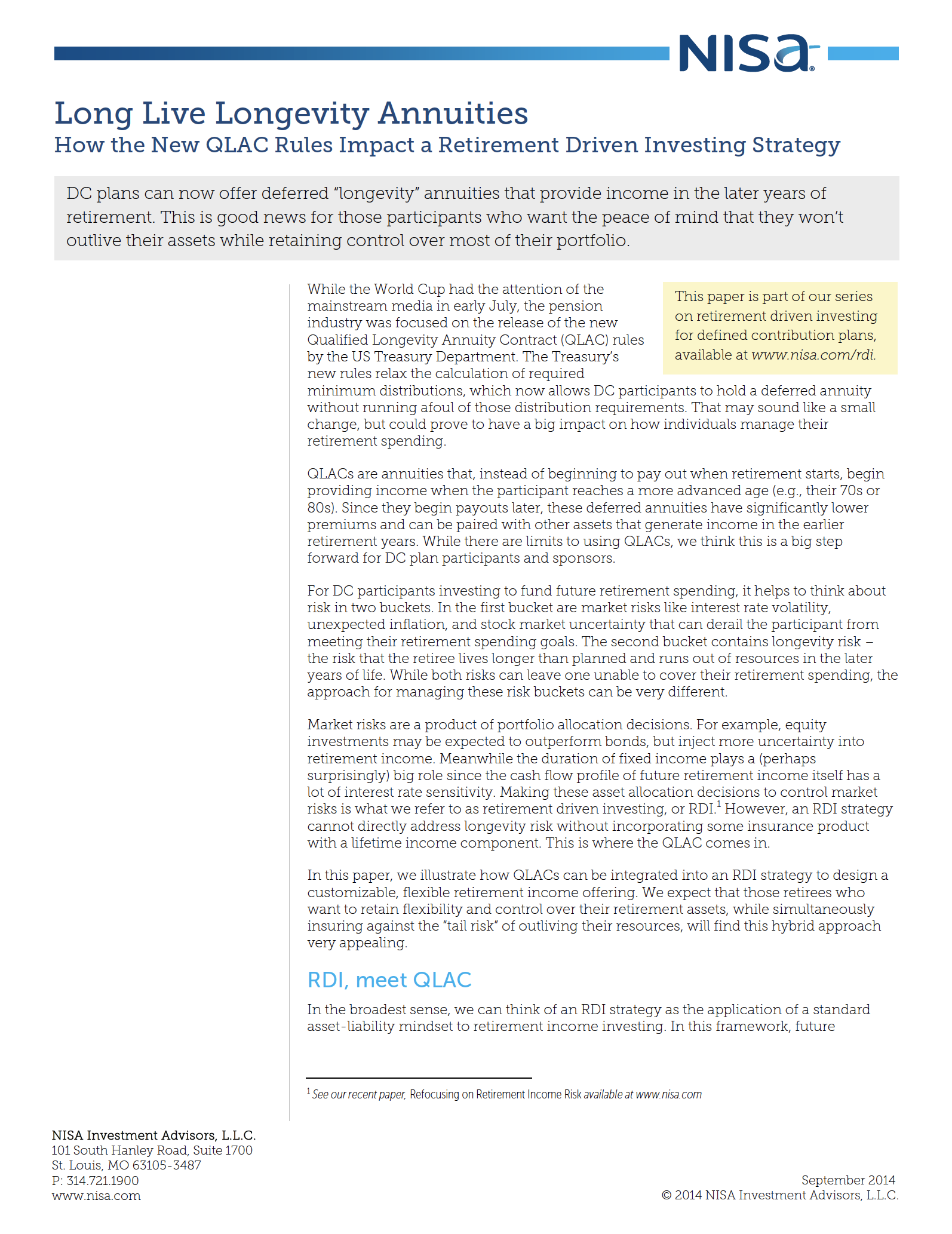

DC plans can now offer deferred “longevity” annuities that provide income in the later years of retirement. This is good news for those participants who want the peace of mind that they won’t outlive their assets while retaining control over most of their portfolio.

RDI, meet QLAC

Conclusion

DC participants may feel wedged between a rock and a hard place when it comes to managing retirement income risks. On the one hand, buying a traditional life annuity to cover all retirement spending provides them guaranteed income that can’t be outlived. But that requires giving up a lot of control and flexibility that may be important when thinking about heirs and unexpected spending needs. That control and flexibility can be retained by funding retirement spending directly from an asset portfolio, but leaves the participant worrying that they’ll live “too long” and run out of money.

Participants now have an escape from this dilemma. By opening the door to longevity annuities within DC plans, the Treasury Department has moved us closer to the goal of stable and flexible retirement income for individual participants. With the new QLAC rule, participants now have the ability to balance their desire for both secure lifetime income and control over their retirement assets. Since those competing needs have perhaps contributed to low adoption of traditional annuities, we expect that longevity annuities will be popular.7

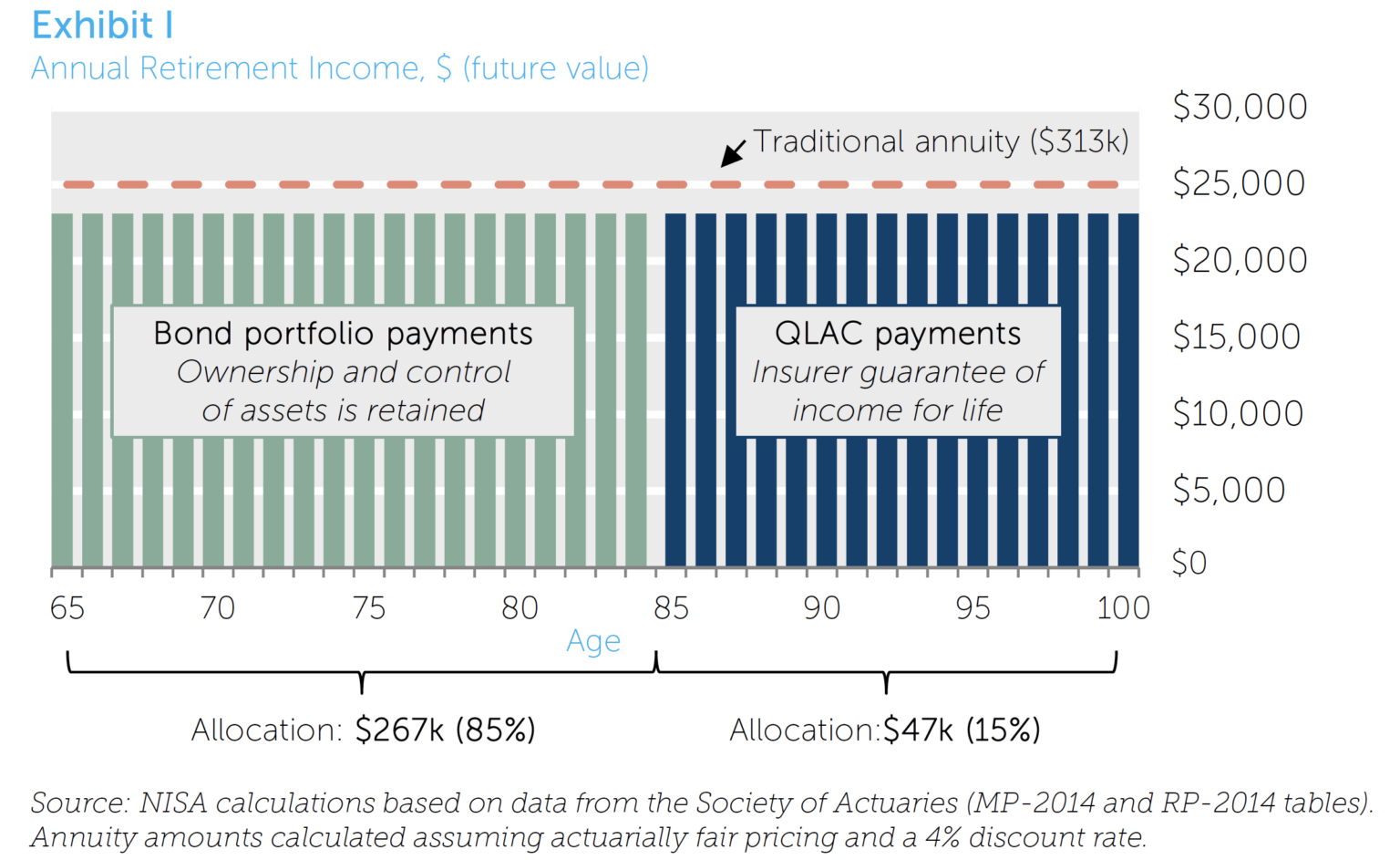

The real value of the QLAC rule may lie in its synergy with a retirement driven investing (RDI) strategy. A participant’s RDI strategy can easily include a longevity annuity, regardless of when the purchase occurs. For the many millions of Americans planning to rely on income from their defined contribution account, this growing array of strategies and tools for managing retirement risks is most certainly news to celebrate.

David Eichhorn, CFA

Managing Director, Investment Strategies

(314) 721-1900

Robert Krebs, CFA

Director, Client Services

(314) 721-1900