Worst bond market since…?

As we recently witnessed the worst bond market since professor Fermi’s first nuclear reactor, many NDT sponsors may find themselves with sizeable realized – and unrealized – losses in their NDTs for the first time since perhaps the Great Financial Crisis (GFC). The difference between now and the GFC is that losses occurred in fixed income portfolios instead of equity portfolios.

Soaring Treasury yields generated losses across a broad spectrum of fixed income assets. Treasury securities are very liquid and are sufficiently heterogeneous to allow for efficient management of wash sales, providing opportunities to relatively cheaply realize losses in portfolios benchmarked to indices that contain Treasury securities by turning the Treasuries over in a rising rate environment. Harvesting losses in credit and securitized securities requires more skill as managers need to be cognizant of transaction costs and portfolio positioning. While an NDT fixed income manager with any meaningful turnover likely harvested material losses over the past few years, they may still have an opportunity to harvest losses today. The question facing NDT sponsors now: What’s next?

Carry them back (if you can) or forward (not too long though)

If offsetting gains are unavailable, the tax benefit of investment losses is diminished. Losses should only be harvested if they can be used to offset gains or future expected gains.

The primary benefit of realized losses is that they can be used to offset gains realized elsewhere in the trust. In order to capitalize on the benefits of loss harvesting, an NDT sponsor needs to be aware of the expiry associated with such trading activity.

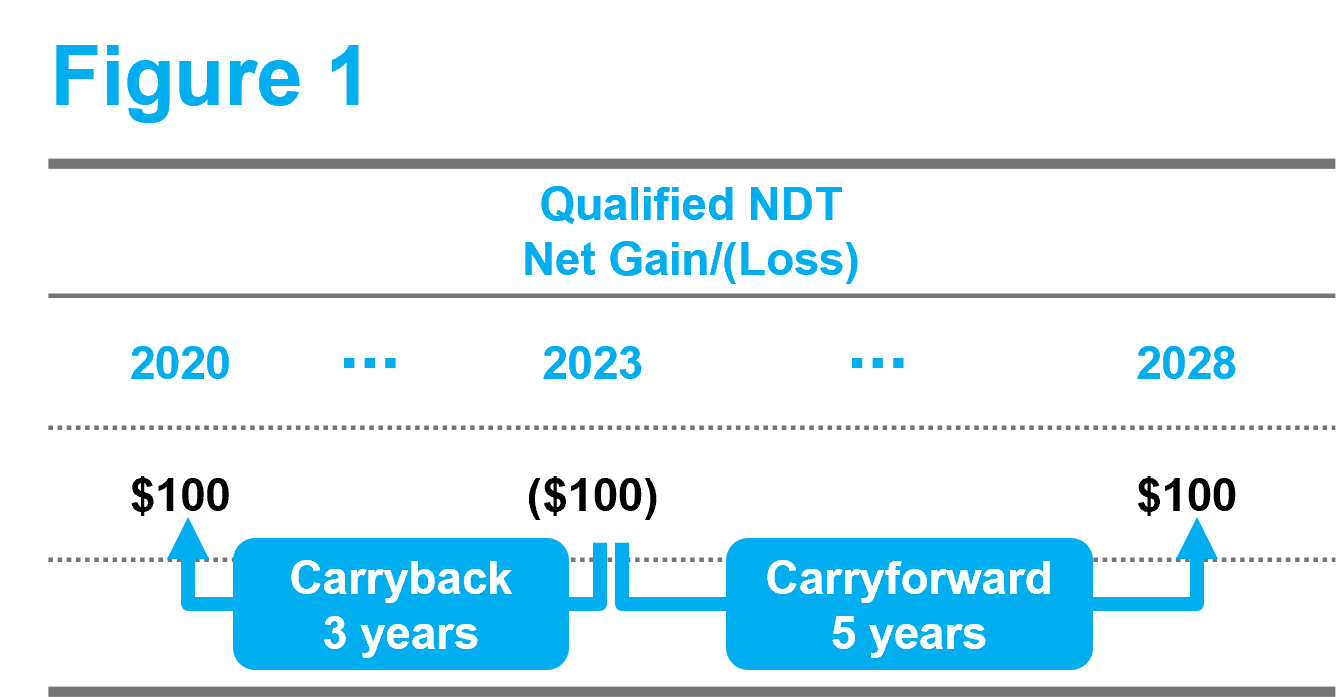

Because qualified NDTs comprise over 90% of the taxable NDT assets, naturally, most of the loss harvesting would have occurred in these trusts as opposed to their smaller nonqualified counterparts. A qualified NDT is allowed to carry losses back up to three years, and forward up to five years, to offset any past or future realized gain. A general illustration of this timeline is shown in Figure 1 below.

As we illustrate in the next section, the economic benefit of utilizing harvested losses diminishes with time, so even without the timing constraints above, a qualified NDT sponsor would be well advised to act sooner rather than later. While we leave it to the tax accountants to determine the best course of action when it comes to tax filings, there may be investment decisions NDT sponsors need to make if unutilized losses remain in 2024 and beyond.

One such example may be rebalancing the asset allocation. Recent performance in the equity market, combined with the fixed income market moving in the other direction, may mean the allocation to equity has drifted above desired targets. Rebalancing this drift could be an easy way to accomplish two goals: 1) resetting the portfolio closer to target allocations and 2) reaping the economic benefits of loss harvesting. Even if the asset allocation is at policy target, the second goal could still be accomplished by having equity managers reset the basis of their portfolios by rotating the positions at gains.

None of this is to say that the nonqualified trusts should be ignored. While indeed smaller in size, they may have realized losses sufficient to at least prompt a conversation with the sponsor’s tax accountants.

Don’t sleep on this

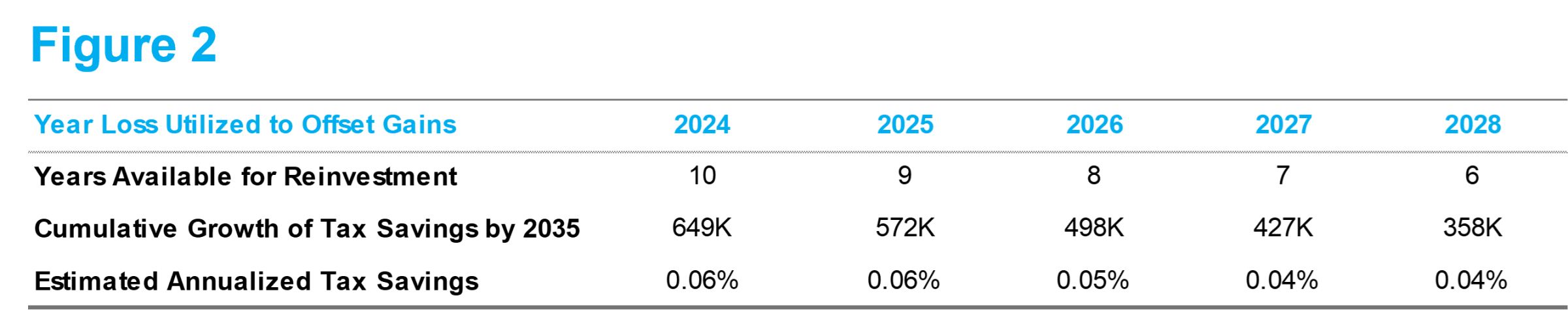

The economic benefit of loss harvesting is real and time sensitive. To illustrate this, we compared reinvesting the same amount of tax savings from loss harvesting during 2024 versus the subsequent four years. As such, in Figure 2 below, the first column assumes that the losses are used to offset gains in 2024 with the tax savings reinvested for the next 10 years (2025 – 2034) while the second column assumes that the gains are offset in 2025 with the tax savings reinvested for the next nine years (2026 – 2034), and so on.

For simplicity, we assumed that $10 million in losses is used to offset $10 million in gains in a $100 million portfolio, which, given a 20% tax rate, would result in $2 million in tax savings compared to simply paying taxes on the realized gains. We used 4% for both the annual return assumption and the discount rate. Obviously, results may vary depending on the assets chosen for reinvestment, but timing considerations alone paint a fairly clear picture: the longer the delay in offsetting gains with losses, the lower the economic benefit to the trust.

Even worse than delay would be to let realized losses expire unutilized. If there are any unused losses from prior tax years, we strongly recommend investigating how they can be utilized before they expire. Resetting the cost basis on the equity portfolio would be one simple way to do so.

Uncle Sam can have a say

One factor that might influence the timing of using the carryforward is the expected tax regime. While the qualified NDT tax rate has held steady since section 468 of the IRC was created and despite attempts to increase it through various bills, the nonqualified NDTs are subject to the more whimsical corporate tax regime. To the extent a meaningful increase in corporate tax rates is anticipated, a sponsor of a nonqualified NDT might benefit from waiting. A discussion with a tax advisor can help determine the right time period for a trust to take advantage of tax loss harvesting.

It ain’t over until rates are lower

With Treasury rates still elevated, additional losses may still be available to harvest, and NDT sponsors may want to explore further with respective investment managers.