It has been an interesting week. Regardless of your political leanings, Tuesday’s election seems to have already produced another unlikely winner: defined benefit plan sponsors. Between last Friday and yesterday (November 10), the yield on the 30-year Treasury increased 38 bps while the MSCI ACWI jumped 2.2%. This increase in rates and equity prices has boosted funded status, and some rough math shows that plans may have received a significant improvement in the past week.

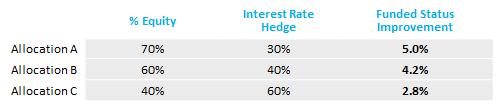

The table below illustrates the effect on funded status for an 80% funded 14-year duration plan with three different asset allocations and interest rate hedges. If for simplicity we ignore yield curve effects and assume equity allocations are invested in the ACWI, we can estimate how much plan sponsors gained in funded status.

Source: NISA calculations.

Plans with lower interest rate hedges and higher equity allocations likely benefited the most, though funded status improvements were probably widespread. For sponsors with de-risking glidepaths in place, this magnitude move could easily trigger their next de-risking step. Quick action may make sense as we believe uncertainty will likely abound in the near future.