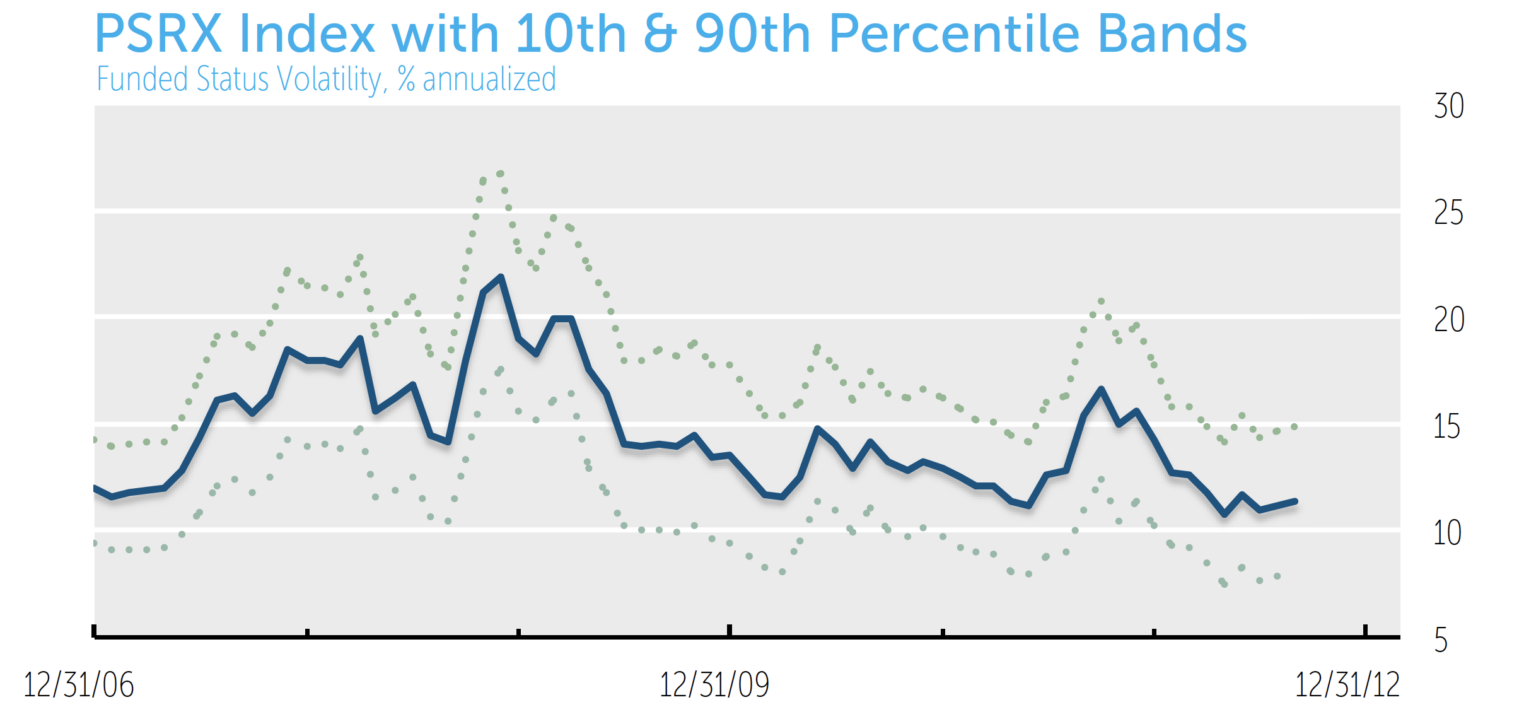

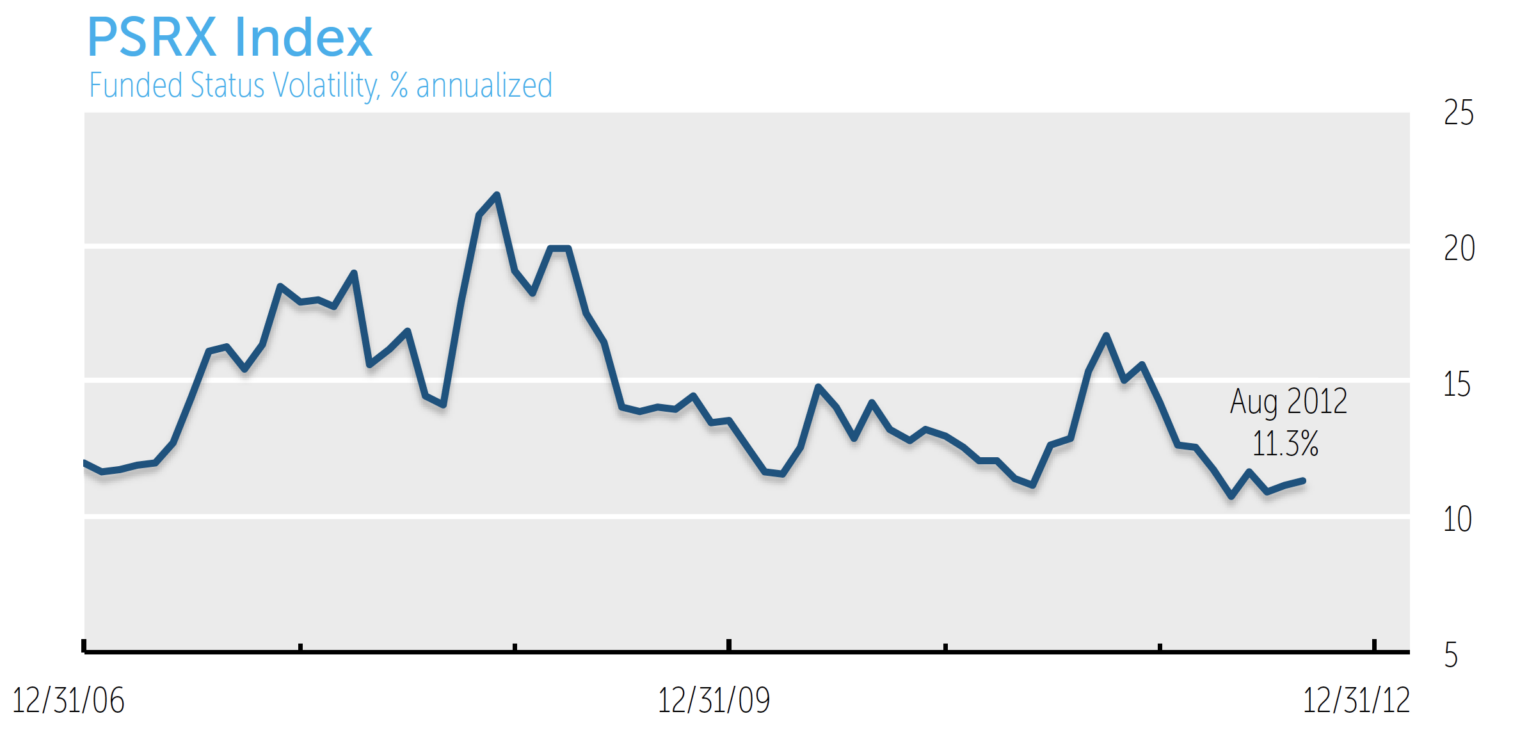

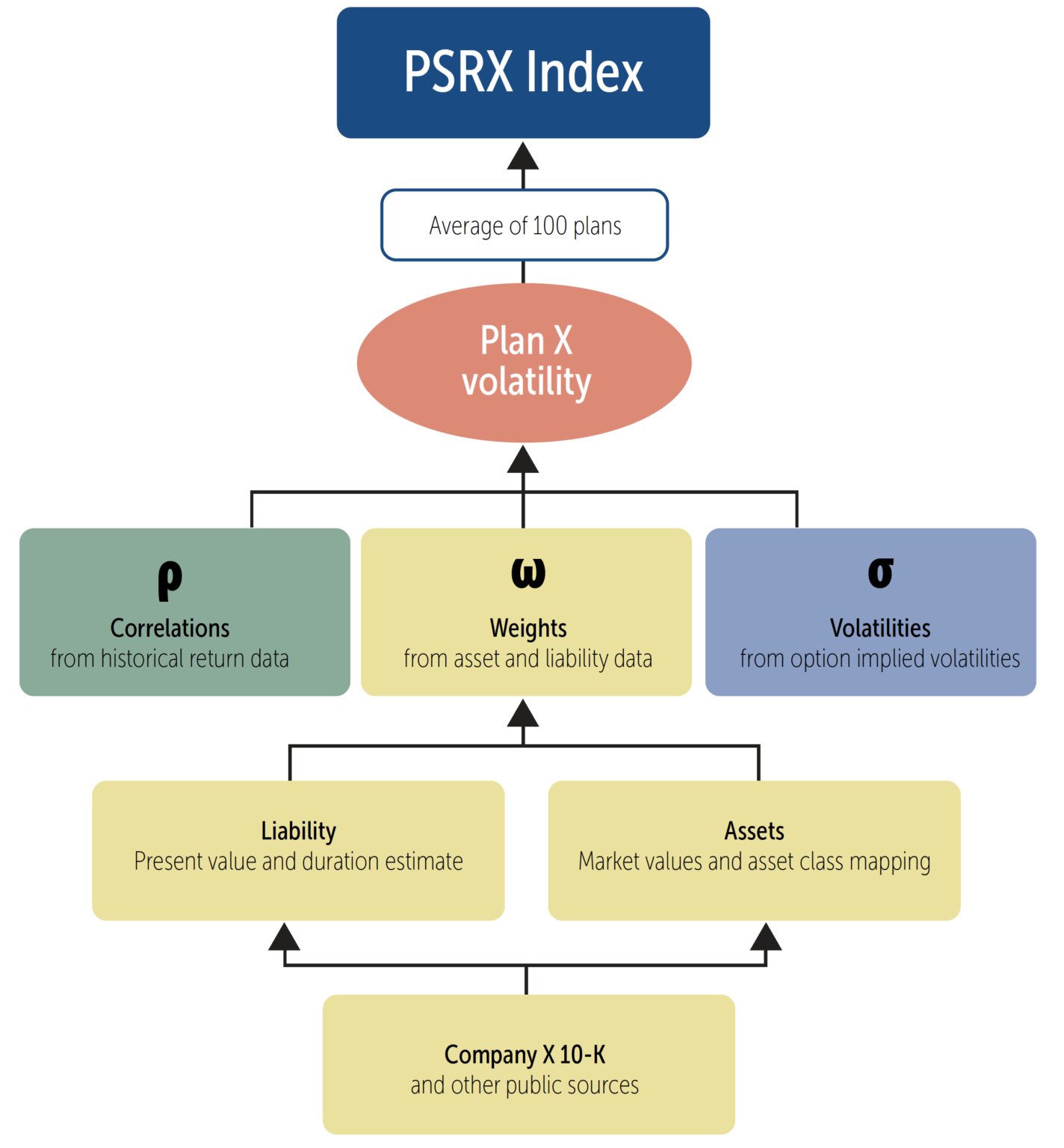

NISA Investment Advisors, LLC (NISA) is pleased to introduce the Pension Surplus Risk Index, or PSRX*, a forward-looking estimate of the funded status volatility of US corporate defined benefit pension plans. The index level represents a one standard deviation change in funded status over a one year horizon, based on the average of the 100 largest pension plans.1 For example, an index value of 15% suggests approximately a one in three chance that a $1 billion plan could lose or gain more than 15%, or $150 million, in funded status in one year.2

We believe the PSRX and its accompanying sub-indices will provide a useful risk measure for CFOs, Treasurers and plan fiduciaries to gauge their pension risk’s influence on enterprise risk, implications for capital structure, and level of beneficiary security, respectively. It is our hope the index, a dynamic measure of surplus risk, offers an additional dimension of context that proves meaningful in framing decisions.

Introduction

Rationale for a New Type of Index

Index Interpretation and Sub-Indices

Methodology Overview

- US defined benefit corporate pension plans;

- Publicly-traded; and

- The 100 largest plans based on pension liability present value (PBO), as determined by NISA from publicly available documents, and re-constituted annually.

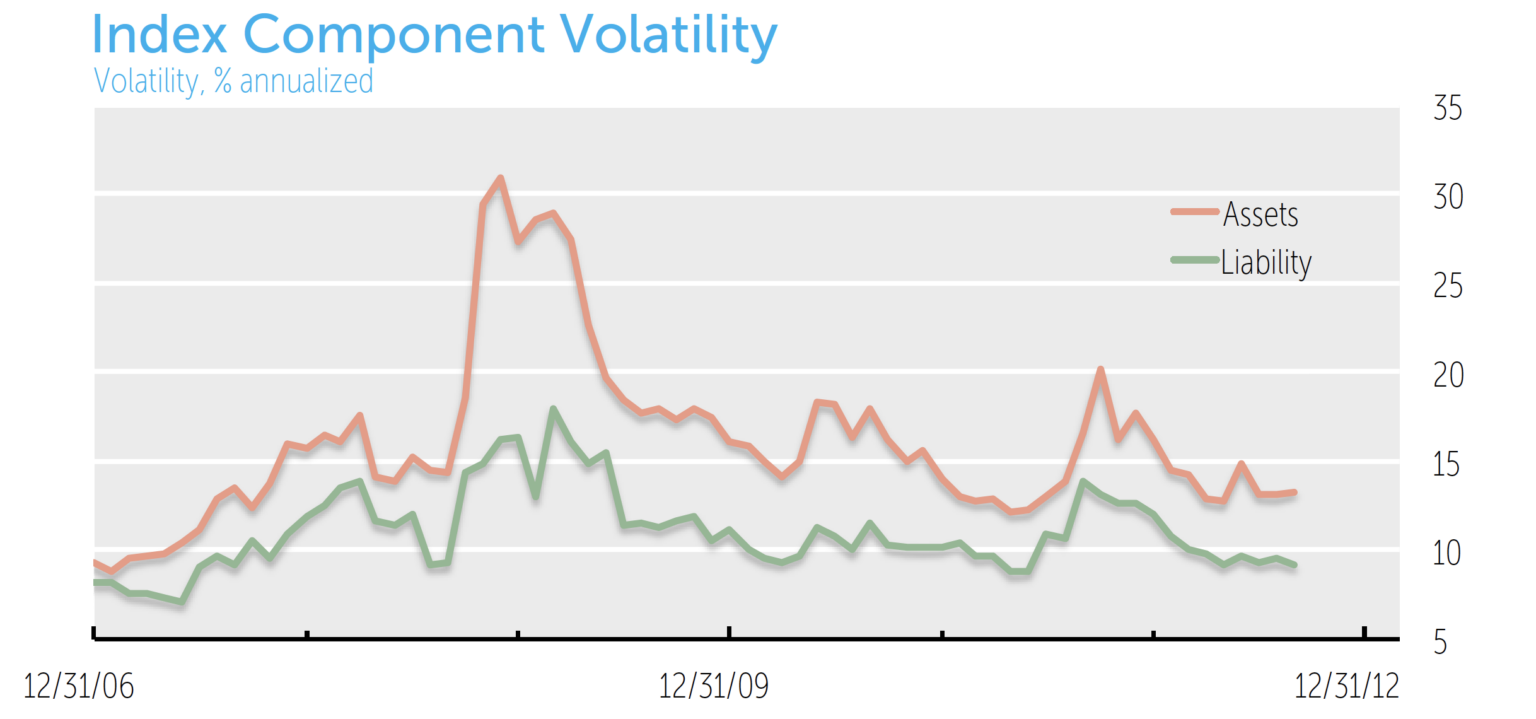

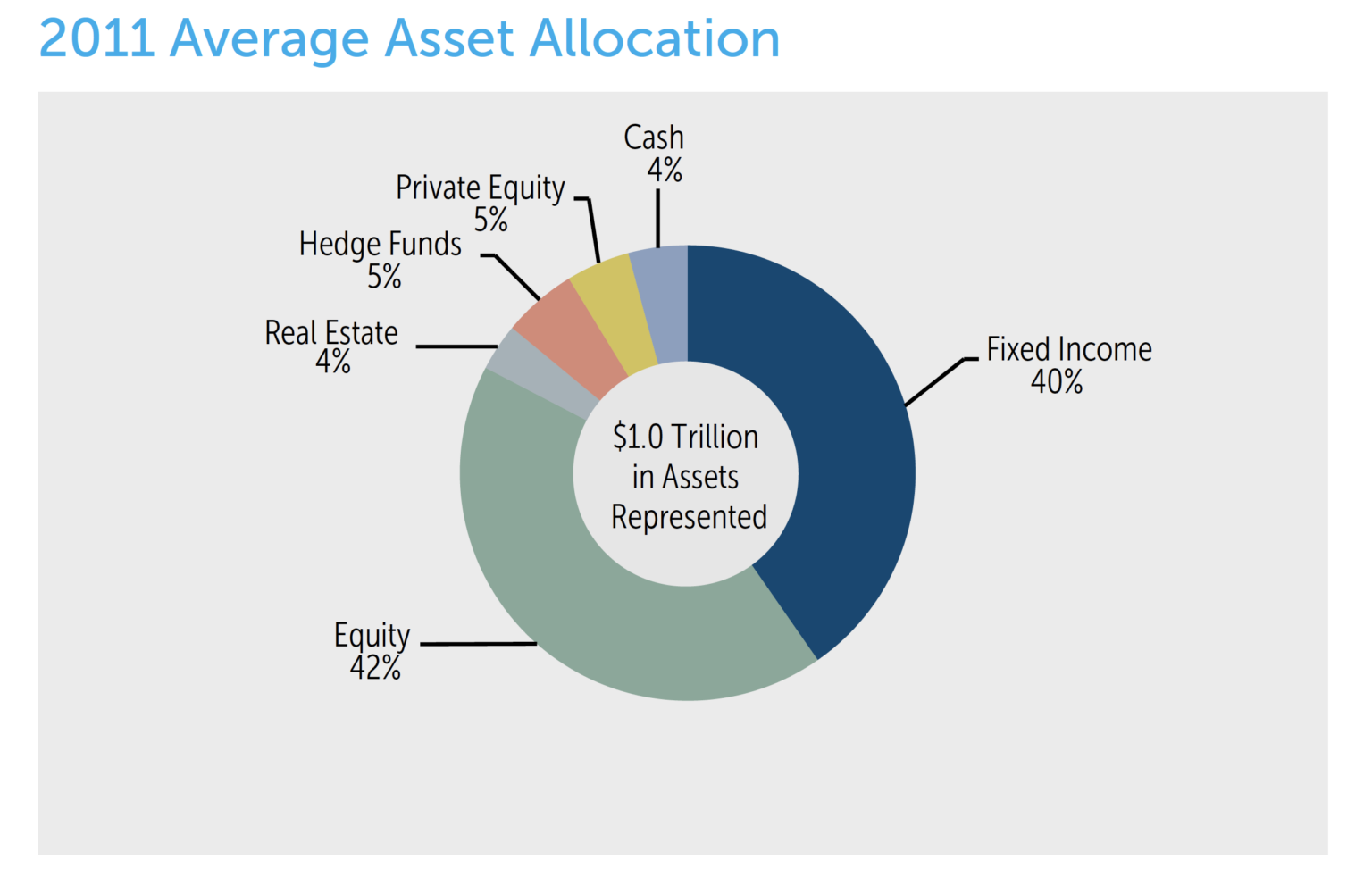

- Plan-specific asset allocation and liability data, derived from publicly available sources;

- Implied volatilities for various markets from traded options; and

- Correlations between the various asset classes and liability components from historical data.

Relevance of Index

Conclusion

Appendix