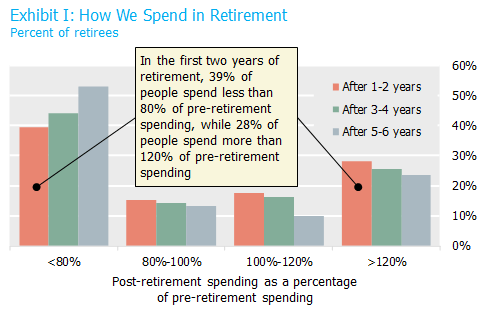

You may have missed that the Employee Benefit Research Institute (EBRI) released a study on retirement spending back in November.* The headline conclusion was that while spending in retirement tends to fall slightly over time on average, the spending patterns of individual retirees vary pretty widely. If markets don’t perform on average, and people don’t retire, spend, or live on average, does it makes sense to design target date strategies based solely on the assumption that the average is reflective of most people’s experience?

Source: EBRI, “Change in Household Spending After Retirement: Results from a Longitudinal Sample.”

How should we interpret these findings? As the EBRI study points out, you have to look deeper into the sources of spending to get a clearer picture. Because while retirement spending patterns differ, the underlying sources of spending for each retiree can be broadly categorized into two main types: needs in retirement, driven largely by basic living expenses, and wants in retirement, typically reflected in lifestyle choices. Over time and through retirement, factors such as health and longevity impact the risks that retirees face and the spending choices that they can or need to make in order to maintain a secure retirement.

But for us, the interesting question is how these findings should impact glidepath construction and the design of target date strategies. If an individual’s spending needs are likely to be unique, and if not all spending is equal in priority, then does a plan designed around simple spending assumptions really suit anyone?

We see a lot of providers in the DC space focused on questions like managing “to or through” which seems to us like a red herring. We think glidepath construction is ultimately an allocation between income-oriented assets designed to meet the certainty and stability of spending needs throughout retirement and growth-seeking assets designed to grow and protect savings to provide for spending wants. And while this framework may be a new way of looking at an old problem, the great news is that the industry already has the tools in place to accomplish this, and, in doing so, bring DC participants closer to true retirement security.

Look for a white paper in the near future from us that will explore this idea further and introduce the philosophy that underlies our glidepath design.

* “Change in Household Spending After Retirement: Results from a Longitudinal Sample” from the Employee Benefit Research Institute, released in November 2015.

To download a PDF version, please click here.