President Trump’s tariff increases put the Fed in a very difficult position. If the current tariff rates of 15-18% are maintained (again, this is The Big If), we would expect the price level to increase by 1.0-1.5% over the next few months, pushing core PCE inflation from 2.6% currently to 3.6-4.1%. We expect that this would be a one-time increase in the price level. We also expect a disinflationary recession would follow later this year. But there is no precedent for a trade policy shock of this magnitude, and the Fed’s war against post-pandemic inflation has not yet been definitively won, so there is a material chance that the tariffs re-ignite a more persistent inflation problem.

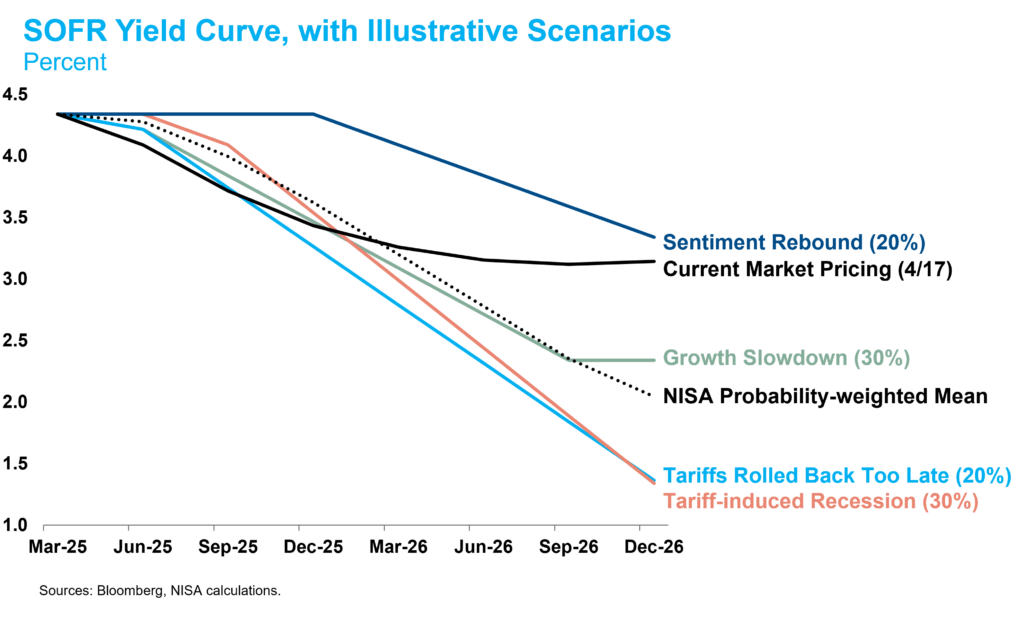

Given this set of challenges, we would sketch out four possible paths forward for monetary policy with approximate odds on each.

-

- Tariff-induced Recession (30%): Trump maintains high tariffs. The Fed is unable to cut rates this summer as they assess whether the inflation shock will be transitory and confirm that inflation expectations have remained anchored. By the fall, the Fed’s concern on those two points will be outweighed by accumulating evidence of a slowing economy and rising unemployment. The Fed begins cutting rates aggressively in September to a terminal rate of 1.25-1.50% by December 2026.

- Tariffs Rolled Back Too Late (20%): Trump cuts deals and reduces tariffs significantly, but the hit to consumer and business sentiment is lasting and the economy slides into recession anyway. In this case, the tariff inflation never fully materializes and the Fed is able to cut rates sooner, arriving at the same terminal rate next year.

- Growth Slowdown (30%): Trump cuts deals and reduces tariffs significantly. Business and consumer sentiment only retrace a portion of their decline since January. Growth remains positive, but falls to around 0.5%, well below potential. The unemployment rate rises gradually and the Fed cuts to a terminal rate of 2.25-2.50%.

- Sentiment Rebound (20%): Trump cuts deals and reduces tariffs significantly. Business and consumer sentiment fully rebound as trade policy expectations revert to the pre-Inauguration Day consensus and focus returns to deregulation and tax cuts. Stagflation never materializes and the Fed reverts to their pre-Inauguration Day gameplan of gradual cuts towards neutral as the post-pandemic inflation battle is finally won. The Fed cuts gradually to a terminal rate of 3.25-3.50%.

The range of possible outcomes is far wider and more complex than these four simple alternatives, with risks in both directions. As previously mentioned, there is some chance that the tariffs ignite more persistent inflation. In that case, the Fed might stay on hold for an extended period or even feel compelled to hike rates. We think the bar to hiking will be quite high, but the odds are greater than zero. If that were to happen, we think a recession would be inevitable so you’d end up in scenario 1 eventually, after an initial increase in interest rate volatility.

That nuance notwithstanding, we find this type of scenario analysis useful for framing our thinking. Comparing our expectations to current market pricing, our probability-weighted path of monetary policy is slightly higher than the market this summer and then much lower than the market thereafter.