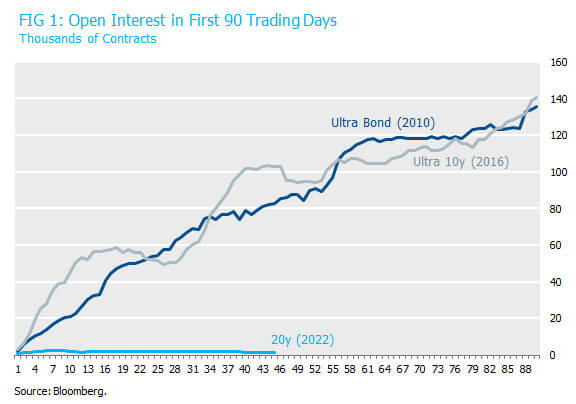

When the CME Group initiated trading on the new 20-year Treasury futures contract in March, we expressed cautious optimism that the new product would gradually develop liquidity to become another tool for hedging long duration interest rate risk. That optimism has been disappointing so far. It seems the 20-year contract never left the starting gate. After two months of trading through May 16, the contract only had 1,600 contracts of open interest. This is a tiny fraction of the open interest that had developed in the Ultra Bond and Ultra 10-year contracts two months after their respective launches in 2010 and 2016 (see Figure 1). The 20-year contract rarely trades more than 200 contracts a day, even on month-end when other long duration Treasury futures trade hundreds of thousands of contracts. Those are the characteristics of a futures contract on the verge of failure.

As we noted in our previous post, the 20-year futures contract has suffered in large part because of the liquidity struggles of the underlying 20-year Treasury bond, which continues to trade poorly and recently offered a yield 22 basis points above the 30-year Treasury. The 20y contract is also a victim of unfortunate timing, having launched in the middle of the single worst quarter of performance in the history of the Bloomberg Treasury Index.

In tacit acknowledgement of the languishing liquidity, the CME Group recently announced a revision to the contract specifications in hopes of spurring more trading activity. Specifically, seasoned, original-issue 30-year Treasury bonds will no longer be excluded from the deliverable basket. This will roughly double the number of bonds eligible for delivery, which CME hopes will increase trading activity. It’s not obvious to us why this amendment would generate much new interest, and it hasn’t happened yet. The decision to amend the contract specifications so soon after a carefully-considered launch has a whiff of desperation about it.

Treasury futures will begin rolling from the June to the September contracts in the next couple of weeks. The revised deliverable basket for the 20-year futures takes effect starting with the September contract. As of this writing, there has not been any trading activity in the September 20-year futures contract. We’re certainly rooting for activity and another option for liability-hedging, but so far, the 20-year seems to be a non-starter.