We hear annuity buyouts frequently discussed as a silver bullet to reduce pension plan risk. Whether buyouts are the right de-risking option was the main topic at the October Pension & Investments’ Pension Settlements Strategies Conference , which we cosponsored for the third year in a row. Judging by the interest we saw at the conference, plan sponsors are engaged and informed about this debate.

We think a lot of this back-and-forth actually overlooks an important practical reality – namely, that a full-plan buyout is probably not an option, especially for larger plans. Instead, partial buyouts of only the retirees have been the norm, and probably reflect the insurers’ desire to take only that subset of plan participants. So while a lot of the discussion has focused on theoretical full-plan annuity buyouts, partial buyouts have gotten short shrift. This strikes us as worth exploring.

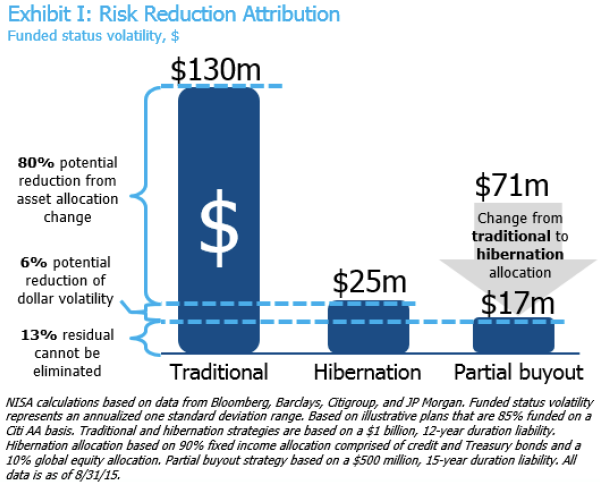

The chart below, from our recent paper on the topic, shows how funded status volatility changes with a partial buyout strategy. We’ve started with a $1 billion plan comprised of $500 million of obligations to retirees and $500 million to active/term vested participants. The plan starts at 85% funded and is invested along a traditional 60/40 allocation. Given the market’s current estimate for interest rate and equity volatility, the plan starts with a 13% or $130 million annual funded status volatility.

Now imagine the plan transfers the retirees to an insurer (along with the cash to cover the pro-rata funding deficit and the buyout premium). If it keeps the 60/40 allocation for the remaining assets, volatility is only cut to $71 million, still leaving the plan with more than half its initial risk. This makes sense, because while the remaining participants are half of the liability’s dollar value, they have a disproportionate share of its risk, specifically a longer duration and more longevity risk.

If that same partial buyout strategy is followed by hibernating the remaining assets, then the $71 million of volatility can be reduced to $17 million. Hibernation alone, however, could have delivered the vast majority of that risk reduction. If the plan had simply hibernated in the first place, instead of doing the partial buyout, it could have expected only $25 million in funded status volatility, without the time and expense of the buyout.To us, the key takeaway is that a partial buyout only secures an additional 6% reduction in risk beyond what hibernation alone is capable of for this plan—and to get to that 6%, the plan must hibernate its remaining assets after a partial buyout is transacted.None of this is meant as an across-the-board criticism of buyouts. We know that for some plans, a full or partial buyout can make a lot of sense as part of their de-risking strategy. But a partial buyout alone, unless paired with a hibernation strategy, may feel like an expensive way to achieve an underwhelming reduction in plan-wide pension risk. Caveat emptor!