It should surprise no one that many active fixed income managers tend to have systematic beta exposure—meaning, they tend to perform well when the overall credit market does well, and underperform when it doesn’t. For Long Government/Credit managers, the likely explanation for this relationship is that most managers consistently overweight credit. As a result, they receive the extra return in good times when credit spreads tighten, then lag when spreads widen.

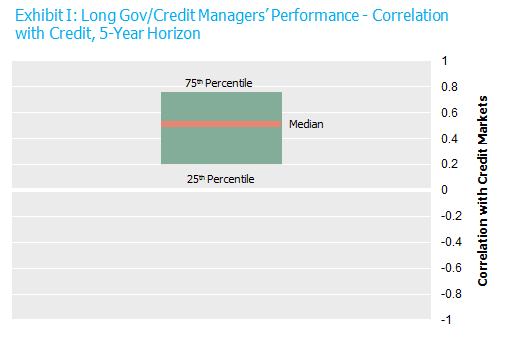

What is surprising, however, is the degree and pervasiveness of this beta exposure. We’ve analyzed data from the eVestment Analytics database of managers benchmarked to the Barclays Long Government/Credit index. The results are striking. Exhibit I shows the correlation between the performance of Long Gov/Credit managers versus the index and the performance of the corporate bond market. The median correlation is a whopping 0.5.*

Source: Based on data from 03/31/11 through 03/31/16 from eVestment Analytics, Bloomberg, and Barclays.

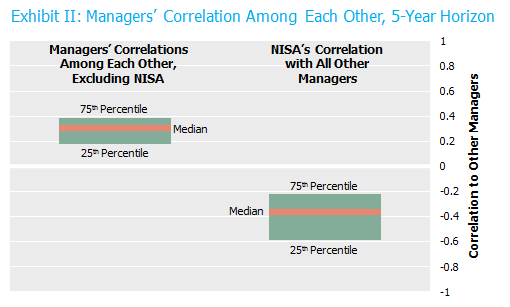

If most managers’ outperformance is correlated with the credit markets, it would follow that they will also be correlated to one another. The data bears this out. This first bar in Exhibit II shows Long Gov/Credit managers’ correlations to each other (excluding NISA). Their average correlation among one another was 0.3.

Source: Based on data from 03/31/11 through 03/31/16 from eVestment Analytics, Bloomberg, and Barclays.

NISA, on the other hand, is generally negatively correlated with most other managers – a median correlation of -0.3.

Having beta in your alpha doesn’t necessarily denigrate the strategy. In our opinion it does, however, change the quality of the excess returns. Investors generally desire strategies that are uncorrelated with the large beta positions they naturally hold in their portfolio. The correlation of managers to the market and to each other warrants careful consideration for how best to build a portfolio of active managers.

* There are shortcomings to using databases, including limitations on inclusiveness and survivorship bias. Benchmarks identified in the eVestment Analytics database are selected by the product’s investment manager and may not be indicative of the true product benchmark.